Between 2024 and 2026, India quietly crossed two inflection points:

- Retail algorithmic trading has evolved into a formally regulated ecosystem

- AI entered trading workflows, but not in the way most people expected

This guide explains what algorithmic trading means in the Indian context, how it works, what is legally permitted, the types of strategies commonly used, the risks involved, and the career paths that have emerged around systematic trading. It answers the questions serious traders are asking in 2026:

- What exactly is allowed under the new SEBI retail algo trading framework?

- As a retail trader, how can I start algo trading in India?

- What are the risks involved?

- Is it possible for retail traders to make money?

- Should I use LLMs, Chatbots, MCPs to create trading bots?

What Is Algorithmic Trading in India?

In India, the regulatory definition of algorithmic trading broadly refers to orders generated using automated execution logic rather than manual placement.

An algorithm does not need to be complex to qualify. A simple rule that automatically sends orders based on predefined conditions can be considered algorithmic trading, depending on how the execution happens.

How Algorithmic Trading Evolved in India

Algorithmic trading was formally permitted in India in April 2008 with the introduction of Direct Market Access (DMA). For many years, it remained concentrated among institutional proprietary desks and high-frequency trading firms due to high infrastructure and compliance costs.

This began to change after 2019 due to three developments:

- Broker APIs became widely accessible to retail clients

- Python and modern data tools lowered the technical barrier

- Cloud infrastructure reduced deployment costs

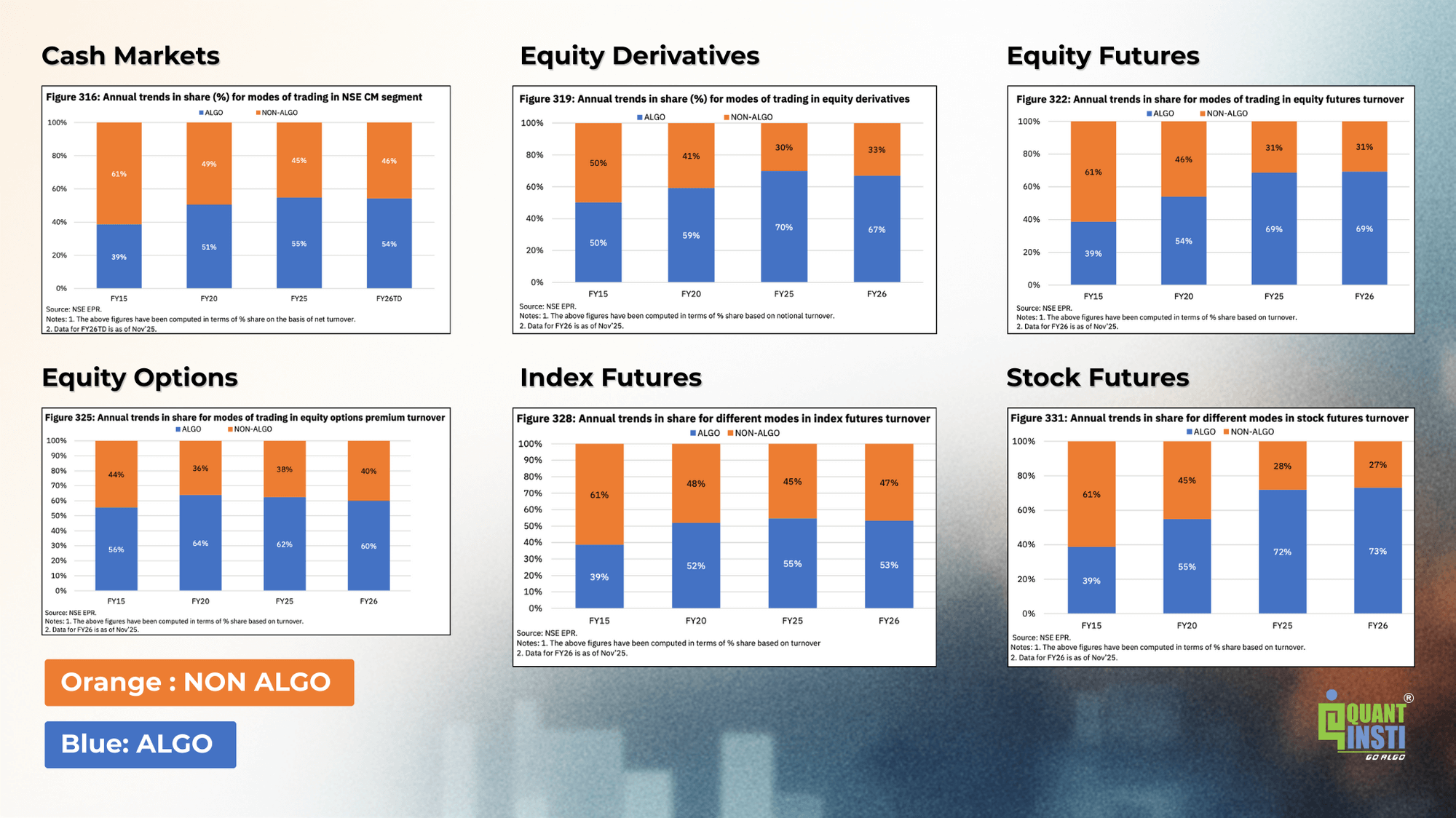

As per NSE’s December 2025 report on Market Pulse, this is the breakdown of Algo & Non-algo trading in India across different trading segments over the years

It suggests that algorithmic trading has steadily become a central feature of trading activity on the NSE, though its adoption varies significantly across segments.

Highest to Lowest Algo Participation in Different Sectors on NSE

- Stock Futures: Algo participation has risen sharply from 39% in FY15 to 73% in FY26TD, representing one of the most significant shifts toward automated trading.

- Equity Futures: Algo share increased from 39% in FY15 to 69% in FY26TD, reflecting strong adoption of algorithmic strategies.

- Equity Derivatives (Overall): Algo participation expanded from 50% in FY15 to 67% in FY26TD, clearly establishing automated trading as the dominant mode.

- Equity Options: Structurally algo-heavy throughout the period, with algo share rising from 56% in FY15 to around 60% in FY26TD, after peaking at 64% in FY20.

- Cash Market: Algo participation increased gradually from 39% in FY15 to 54% by FY26TD, indicating a steady shift while non-algo flows remain meaningful.

- Index Futures: Algo participation has grown more moderately, from 39% in FY15 to 53% in FY26TD, reflecting a slower but consistent evolution.

Taken together, the data reflects a clear and consistent trend rather than abrupt shifts, with algorithmic trading steadily gaining share across all segments and becoming most dominant where scale, execution efficiency, and systematic positioning are critical.

Why SEBI Introduced a Retail Algo Framework

SEBI’s retail algorithmic trading framework was introduced primarily to address regulatory gaps that emerged as broker APIs and third-party algo solutions became widely accessible to retail investors.

The retail algo framework was therefore designed to:

- Formalise the use of broker APIs by retail investors

- Bring third-party algo providers within a defined regulatory perimeter

- Assign clear responsibility to brokers for monitoring and controls

- Ensure auditability and traceability of algorithmic orders

- Curb opaque distribution and misleading marketing of algorithmic strategies

The intent may not be to restrict retail participation in algorithmic trading, but to legitimize it through structured access, transparency, and enforceable safeguards.

FAQs for Retail Traders

1. Is retail algorithmic trading allowed in India?

Yes.

- SEBI explicitly allows retail traders to use algorithmic trading through broker APIs, subject to defined controls and safeguards.

- Retail algo trading must operate within broker-controlled environments, not unrestricted or anonymous open APIs.

2. Can I build and run my own trading algorithm?

a) Trading for yourself

Yes. Retail traders are permitted to develop and use their own algorithms for trading their own accounts.

- Exchange registration (through your broker) is required only if the algorithm exceeds the prescribed order frequency threshold.

- Below this threshold, registration is not required.

- Brokers are responsible for monitoring order rates and enforcing limits.

b) Offering your algorithm to others

If you intend to offer an algorithm to other clients, additional regulatory requirements apply.

- The algorithm must be routed through a broker-controlled environment.

- The provider must comply with exchange empanelment requirements.

- If the algorithm is a black box (logic not disclosed), the provider must:

- Be registered as a SEBI registered Research Analyst (RA)

- Maintain a detailed research report for the algorithm

- Treat material changes as a new algo trading strategy.

These requirements govern distribution, not personal use.

3. When does my self-built algo need registration?

Your algorithm needs to be registered if it places more than 10 orders per second per exchange.

Key points:

- The current limit is 10 orders per second

- Brokers are required to monitor order rates and reject orders that breach thresholds

4. Who is responsible if something goes wrong with an algo trade?

Under the SEBI framework, the broker is the principal responsible entity.

This means:

- Brokers are accountable for monitoring and controls

- Brokers handle grievances and regulatory compliance

- Algo platforms and technology vendors operate as agents

As a trader, your algo access is always mediated through the broker’s systems.

5. Are all algo orders tracked by the exchanges?

Yes. Every algorithmic order routed through APIs must carry a unique exchange-issued identifier.

This ensures:

- Full traceability of each order

- A complete audit trail

- Identification of whether the algo was client-built, broker-provided, or vendor-supplied

6. What security requirements apply to retail algo trading?

Retail algo trading through APIs is allowed only with strict security controls, including:

- Static IP whitelisting of client systems

- Client-specific and vendor-specific API keys

- Strong authentication (such as two-factor authentication)

Exchanges also impose limits on:

- How frequently static IPs can be changed

- How infrastructure may be shared across related or family accounts

These rules exist to prevent anonymous or uncontrolled automated trading.

7. What is the difference between white box and black box algos?

SEBI clearly distinguishes between two types of algorithms:

White Box Algos

- Logic is disclosed and understandable

- Can be independently replicated

- Typically includes execution algos and transparent rule-based strategies

Black Box Algos

- Logic is not disclosed or cannot be independently verified

8. Can I use black box algos as a retail trader?

Yes, but additional rules apply to the provider, not the trader.

For black box algos, the provider must:

- Be registered as a SEBI registered Research Analyst (RA)

- Maintain a detailed research report for each algo

- Treat material changes as a new algo trading strategy

This framework governs how such algos can be distributed to retail clients.

9. Are algo platforms and vendors regulated?

Yes.

- Algorithmic trading vendors must be empanelled with exchanges.

- Brokers are required to conduct due diligence before onboarding vendors.

- Only empanelled providers can offer algo products through broker systems.

10. When does the new framework fully apply?

- The framework was notified in early 2025 but follows a phased implementation.

- Broker readiness and testing occurred through 2025.

- Operational rollout continues into late 2025 and early 2026.

This phased approach allows brokers and traders to adapt smoothly.

11. Does the SEBI framework restrict innovation?

No. The framework is designed to enable retail algorithmic trading while ensuring safety, transparency, and accountability.

Retail traders can:

- Build their own algos

- Use broker-provided or vendor algos

- Participate in automated trading under a well-defined framework

How Algorithmic Trading Strategies Make Money

Algorithms make money the same way any trading approach does. They identify a repeatable edge, execute it consistently, and manage downside risk when conditions change.

Common sources of edge include:

- Statistical tendencies such as mean reversion

- Trend persistence under specific regimes

- Market microstructure patterns that survive costs

- Execution efficiency and reduced slippage

Algorithms do not eliminate uncertainty but they can help in reducing inconsistency.

Common Categories of Trading Strategies

A few of the popular trading strategies and the underlying reasons/factors are listed below.

| Strategy Category | Quant | Technical | Fundamental |

|---|---|---|---|

| Trend-following |

|

|

|

| Mean-reverting |

|

||

| Break-out |

|

|

|

| Carry |

|

|

|

| Event-based |

|

|

Risks Retail Traders Commonly Underestimate

Effective trading risk management requires accounting for the following factors:

- Transaction Costs and Slippage: Realistic trading involves more than just the entry price. You must deduct the total transaction cost (brokerage, levies, and taxes) from every trade. Additionally, slippage often occurs in low-liquidity or high-volatility environments, where your order is filled at a worse price than expected, significantly eroding narrow margins.

- Overfitting: This occurs when a strategy is "parameter-fitted" to historical noise. An overfitting model shows an impressive equity curve on past data but collapses in live markets because it lacks the flexibility to handle changing market structures.

- Operational Risk: Technology is a single point of failure. Operational risk includes API downtime, server crashes, or faulty code execution. Robust trading setups require "kill switches" and position limits to prevent catastrophic losses due to any potential technical glitches.

- Crowding and Strategy Decay: As a profitable pattern becomes public knowledge, more capital chases the same "edge." This crowding leads to strategy decay, where the alpha is traded away, making the strategy progressively less effective over time.

Using LLMs and Chatbots in algorithmic trading

You should use LLMs, chatbots, and MCPs to build trading bots as support tools, not as decision-makers (at least as of now!). Tools like ChatGPT, Copilot, or Claude can dramatically speed up coding, help translate scripts (e.g., Python to Pine Script), explain complex code, and accelerate backtesting and prototyping even for non-expert programmers.

However, you should not rely on LLMs to generate profitable trading strategies. They may not understand markets, may produce generic ideas, and can make subtle but serious mathematical or financial errors. There is no “secret sauce” embedded in a chatbot.

Where AI truly adds value is in processing unstructured data (such as news, earnings reports, or Fed speeches for sentiment signals), filtering information, and generating synthetic scenarios to stress-test strategies under rare or extreme conditions. For a hands-on walkthrough, see Trading Using LLM: Concepts and Strategies by Dr Ernie Chan.

Use low-code/MCP platforms for rapid experimentation but always validate with rigorous backtesting. AI should assist your process, not replace your judgment.

Read all about AI for trading here.

Getting Started Based on Your Background

New to Trading & Coding

You have little to no experience in financial markets. You want to skip manual trading and go straight to algos. You cannot automate what you do not understand. Your first goal is to understand the market.

Step 1: Market Fundamentals (Non-Negotiable)

- Learn the basics of Indian Equities and Derivatives. Understand "Market Microstructure", how an order actually matches (Bid/Ask, Liquidity, Slippage), transaction costs.

- Resources:

Stock Market Basics

Options Trading Strategies in Python: Basic (skip the code part in the course)

Step 2: "Gray Box" Trading

- Don't build a robot yet. Use "screeners" to find trade setups automatically, but execute them manually. This teaches you to trust data over gut feeling.

- Tools: TradingView.

Step 3: No-Code Automation

- Once you have a strategy logic (e.g., "Buy when RSI < 30"), try automating it without code to see how execution works.

- Tools: Brokers/vendors offered tools like: Zerodha Streak

- First Milestone: Place a trade based on data

The "Experienced Manual Trader"

You already trade but want to remove emotions, save time, or scale up. Your discretionary "gut feel" is hard to code. You need to quantify your intuition into rules that a computer can understand.

Step 1: Quantify Your Edge

- Write down your strategy in plain English. If you can't write it as a flowchart, you can't code it.

- Example: Instead of "Buy when the trend looks strong," define it as "Buy when 20 EMA > 50 EMA and ADX > 25."

Step 2: Backtesting

- Validate your edge by testing on historical data. Crucially, you must simulate transaction costs and test across various market cycles (uptrends, downtrends, and consolidation). Evaluate success not just by net profit, but by risk metrics like the Sharpe Ratio, Win %, Profit Factor, etc.

- Tools: TradingView Strategy Tester (Easier) or Python (Advanced).

- Resources:

Python for Trading: Basics

Backtesting Trading Strategies

Step 3: Execution Bridges

- You don't need to build a full trading engine. Use tools that bridge your analytical/charting software to your broker.

- Tools: MT5 and Python, Broker APIs like KiteConnect API

- Resources:

Automated Trading using MT5 and Python

Algo Trading with Zerodha Kite - First Milestone: Automate your winning strategy

The "Developer / Coder"

You are proficient in Python or C++, but new to Finance. You might believe you can "solve" the market with sophisticated code. A bug-free code running a flawed financial strategy will just lose money. Your code is the vehicle, but the strategy is the driver. Your primary challenge is Financial Domain Knowledge, not syntax.

Step 1: Bridge the Domain Gap (Trading Strategies) Before writing a single line of execution code, you must understand the logic of trading. You need to learn how to model market behaviour mathematically. Explore core concepts like Momentum, Mean Reversion, and Statistical Arbitrage. Once comfortable, move toward Machine Learning (AI) in trading and Portfolio Management rules.

- Resources: Quantra Learning Tracks

Step 2: Data Engineering Financial data is notoriously "messy." It is not just a standard array; it is a time-series that requires specific handling to be useful.

- Key Skills: Learn to clean Time Series data, adjust for corporate actions (like stock splits and dividends), and handle missing values (NaN) without introducing look-ahead bias.

- Python Stack: pandas (the backbone), yfinance (for free data), and TA-Lib (for calculating technical indicators efficiently).

- Resources: Financial Time Series Analysis for Trading.

Step 3: The Execution Layer (The "API Economy") This is where your coding skills shine. You need to build the bridge between your logic and the Indian stock market infrastructure.

- The Mechanics: Understand the difference between REST APIs (for placing orders) and WebSockets (for streaming live tick data).

- Critical Dev Tasks: Learn about API Rate Limits (to avoid getting banned) and Exception Handling. Ask yourself: "What does my code do if the internet disconnects for 5 seconds?"

- Tools: MT5 (MetaTrader 5), Broker APIs like Zerodha Kite Connect, Angel One SmartAPI, etc.

- Resources:

Automated Trading using MT5 and Python

Algo Trading with Zerodha Kite - First Milestone: Automate a simple moving average crossover strategy

Careers in Algorithmic and Systematic Trading

The ecosystem in India now includes quant roles beyond pure trading:

- Strategy Research and Validation: For those with a knack for identifying market inefficiencies, becoming a quantitative analyst or researcher is the primary path. This role involves using mathematical models to backtest and validate alpha-generating strategies.

- Trading Systems and Infrastructure: The backbone of the industry lies in developing a robust automated trading system. This requires engineers who can build low-latency environments where execution happens in microseconds.

- Data Engineering: Behind every successful strategy is a mountain of organized information. Mastering data engineering for quant trading is essential for managing the high-frequency feeds and massive datasets that drive systematic models.

- Risk and Controls: As automation increases, so does the complexity of potential pitfalls. Pursuing a career as a risk analyst ensures that automated execution remains within safe parameters, protecting the firm from market volatility and technical glitches.

- Compliance, Monitoring, and Audit: Operating in a regulated market requires strict adherence to legal frameworks. Understanding the nuances of setting up and auditing an algo trading desk is critical for maintaining transparency and meeting institutional standards.

What you need to remember

Algo is not easy money! Algo trading is not an ATM machine. You may get fake tips. Algo trading tips in SMS. Because it is the buzzword. And everybody wants to capitalize it. So the first thing is that algo is not an ATM machine.

If trading feels thrilling, you're likely doing it wrong. The more chaotic and unpredictable it is, the lower your odds of consistent profit. Successful trading should be deliberate, methodical, even boring. It’s about discipline and data, not adrenaline. Out of 100 well-researched backtests, you might find just one strategy worth deploying and that one is built on precision, not excitement.

High-Frequency Trading (HFT) is not for retail: HFT is a technology-driven arms race, not suitable for most retail traders. If someone tells you that you can do HFT as a retail investor, they either don’t understand what HFT truly is, or they’re probably misrepresenting what retail trading setup can realistically achieve.

Avoid Herd Mentality & Find Your Own Edge: Just because everyone is shouting, ‘Do options! Do intraday!’ doesn’t mean you should follow blindly. You don’t have to trade a certain way just because others are doing it.

The real question is: Why are you doing it?

If your goal is to make money, stop and think: what’s your actual edge? Without a clear reason, buzzwords are just noise.

Read all about finding your edge here. All images are from our WhatsApp channel. Follow today to learn for free!

As the Indian trading landscape becomes increasingly systematic, the gap between 'knowing' a strategy and 'executing' it safely is wider than ever. For those looking to bridge this gap with a structured, practitioner-led approach, the Executive Programme in Algorithmic Trading (EPAT) offers a natural next step. It is designed to help professionals transition from manual to automated trading by focusing on a "learn-by-doing" philosophy; it ensures that your journey into quants is built on a foundation of reality rather than just theory.

Connect with an EPAT career counsellor to discuss the right quant role for your background.

Disclaimer: This blog post is for informational and educational purposes only. It does not constitute financial advice or a recommendation to trade any specific assets or employ any specific strategy. All trading and investment activities involve significant risk. Always conduct your own thorough research, evaluate your personal risk tolerance, and consider seeking advice from a qualified financial professional before making any investment decisions.