QuantInsti® is a pioneer Algorithmic Trading Research and Training Institute, conducting professional programmes in this rapidly growing domain.

QUANTINSTI'S ALGORITHMIC TRADING BOOK

A rough & ready guide

62,000+ Downloads

About Our Guide to Automated Trading for Beginners

What Is This Book?

Until mid-2019, we had a collection of essays on quantitative trading compiled into a book titled ‘A Beginner’s Guide to Learn Algorithmic Trading’. It was well-received, but we felt that it did not go far enough or deep enough. As content creators in the domain that literally justifies our existence, we had a lot more to say. So, we took some parts of our older book and added a lot more updated and relevant material to weave it together into a (hopefully!) coherent story. And that’s what this algorithmic trading book is, really.

Who Is This Book For?

This book has been written for anyone who wants to learn about the field of algorithmic trading. From our experience, we imagine that our readers would be

- University students,

- Technology professionals,

- Retail traders of different hues (ex. professional traders, or hobbyists who like to actively manage their personal portfolio),

- Anyone eager to know more about applied quantitative finance

Book Structure

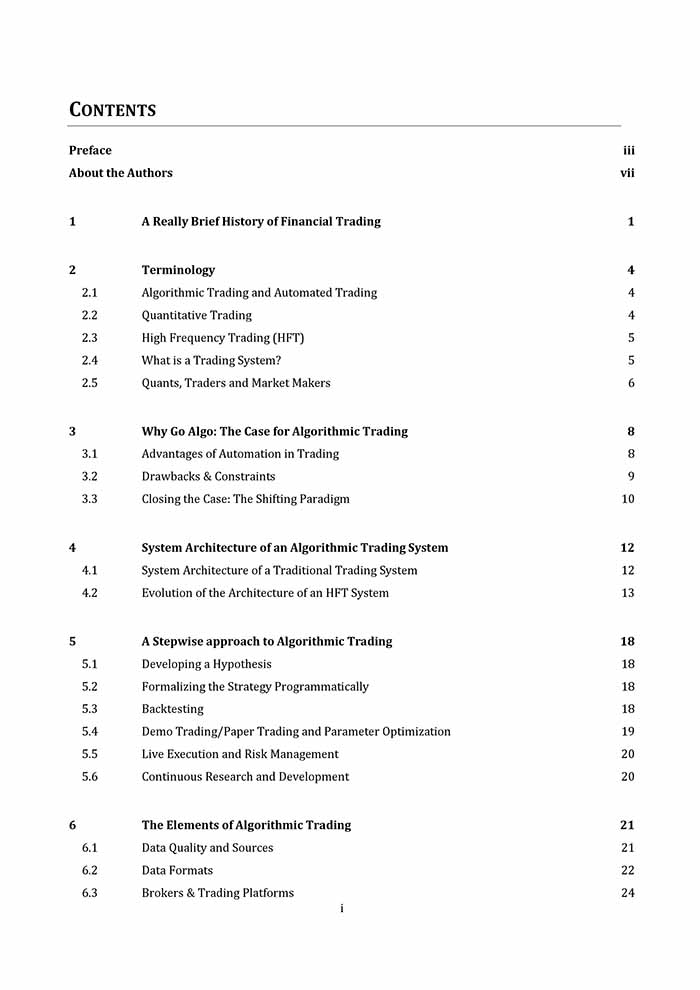

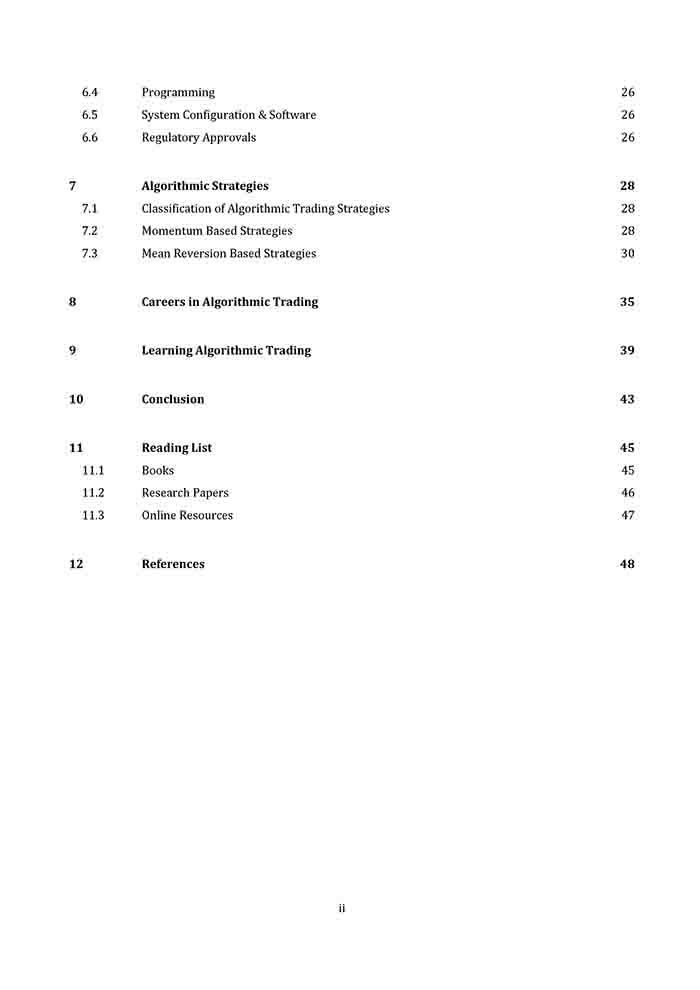

We first introduce the reader to the domain of algorithmic trading by briefly exploring its history and then its terminology. We then proceed to discuss the pros and cons of automated trading. Further, we elaborate, with illustrative examples, on the components needed to create a robust trading system. We also briefly cover some key algorithmic trading strategies. to give you a taste of what’s in store for the more interested among you. We dwell on the skill sets you need to build a career in this domain or to start your own desk. Finally, we close out our work on automated trading for beginners with a recommended reading list and resources for diving deeper.

What This Book Is Not

We do not discuss advanced algorithms or applied quantitative finance strategies in any measure of detail; our aim in this book is more modest viz. to give you a taste of the quantitative way of trading. We also do not teach any programming here. Instead, we will shamelessly self-promote and point you to the book on Python programming co-written by one of us (Vivek Krishnamoorthy) if that’s what you’re looking for. Or many other interesting resources (like blogs/webinars/free courses) on the QuantInsti portal.

TAKE A PEEK INSIDE THE HANDBOOK

You can swipe to preview

Frequently Asked Questions

What are the Prerequisites for reading this book?

We write assuming our readers do not have a background in programming or applied quantitative finance. While an understanding of finance, mathematics or computer science is not necessary, having a moderate grasp on any/some/all of them will make this book an easier read.

Is this algorithmic trading guide really free?

Absolutely. This algo trading for beginners handbook is free and will always be. We believe in sharing some free knowledge that we hope you’ll find useful.

DOWNLOAD NOW!

AUTHORS

Vivek Krishnamoorthy

Vivek is the Head of Content & Research at QuantInsti. He teaches Python for data analysis, building quant strategies and time series analysis to our students across the world. He comes with over a decade of experience across India, Singapore and Canada in industry, academia and research. He has a Bachelors' in Electronics & Telecom Engineering from VESIT (Mumbai University), an MBA from NTU Singapore and a Graduate Certificate in Public Policy from The Takshashila Institution.

Ashutosh Dave

Ashutosh is a quant researcher with more than a decade of experience in financial derivatives trading and quant finance. Currently, he leads a team of quants in a prop trading firm engaged in alpha research and strategy development. Previously, he has worked as a derivatives trader specializing in trading fixed income and commodities with a proprietary trading firm in London where he worked for several years before relocating to India where he later worked as a Senior Associate, Content & Research at QuantInsti.. His key areas of interest include applying advanced data science and machine learning techniques to financial data. Ashutosh holds a Masters in Statistics with distinction from the London School of Economics (LSE) and is a Certified FRM (GARP).