Introduction to AI Trading

At its core, AI in trading involves applying intelligent systems to tasks that once required human cognition: analysing data, recognising patterns, making predictions, and quant practitioners.

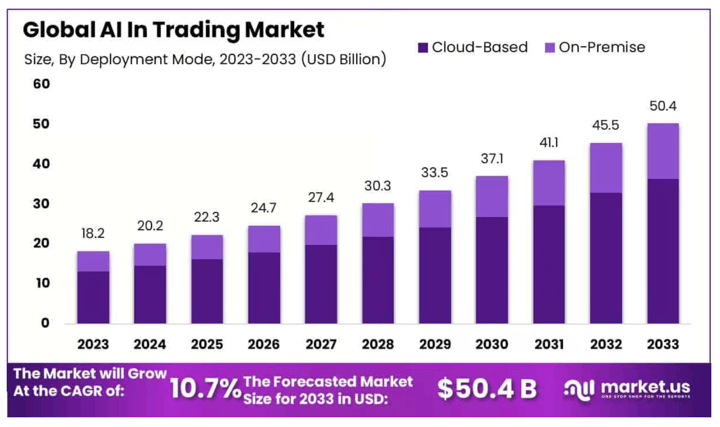

AI is a rapidly expanding segment of the fintech industry, with the global AI trading market valued at $18.2 billion in 2023, projected to nearly triple by 2033.

AI is transforming the trading landscape by enabling both advanced modelling and user-friendly automation.

- At the high end, sophisticated architectures like self-attention and cross-attention transformers analyse complex financial time series to generate powerful features for strategies such as optimal capital allocation through Deep Reinforcement Learning (DRL).

- At the same time, AI bots and large language models are democratizing trading by assisting users, regardless of coding expertise, in building, analysing, and executing trading strategies.

From deep market analysis to intuitive AI assistants, the technology is also reshaping how investors interact with financial markets. So, while there is undoubtedly a lot of buzz and risks around it, AI in trading is far from being just a buzzword.

Peter Cotton referred to LLMs as "an immense leveler"

“It's a terrific time to be a small group, especially if you have, sort of, the greenfield and the ability to reinvent the investment process, as you go about it. You know, if you think about trading, it's just essentially the gathering of information, the processing of it, the reasoning about it, the making of, you know, sensible prediction.”

- Peter Cotton, Algorithmic Trading Conference 2025

Evolution of AI in Trading

The application of machine learning models and artificial intelligence in trading and investment began in the 20th century and has gained significant momentum in recent years.

- 1960s – Early ML in Finance: The foundations of AI in trading began in the 1960s with quantitative pioneers like Ed Thorp, who used computers for statistical arbitrage and portfolio optimisation. This marked the first wave of systematic trading.

- 1980s–1990s – Classical Machine Learning: As computing power grew, firms began applying early machine learning techniques like decision trees and support vector machines. Hedge funds, such as Renaissance Technologies, leveraged these models for predictive analytics and strategy development.

- 2010s – Rise of Deep Learning: The deep learning era brought neural networks, CNNs, and RNNs into the trading world. These models could identify complex temporal and spatial patterns in financial data, powering more dynamic trading strategies.

- 2020s – Generative AI & LLMs: Large Language Models (LLMs) and generative AI transformed the landscape again. These models now assist in research automation, generate new trading features, and even help design entire trading strategies autonomously.

Generative AI provides crucial assistance in the earliest stages of trading: Idea generation and research automation

Matteo Campellone noted that LLMs "provide a lot of ease in accessing information, summarizing information, extracting also, you know, information from a large number of sources"

“I would sit, rather on a discretionary trading desk, generally speaking. They provide a lot of ease in accessing information, summarising information, extracting also, you know, information from a large number of sources.”

- Matteo Campellone, Algorithmic Trading Conference 2025

How is AI used in different steps of trading?

AI is integrated across the entire trading process, from raw data to trade execution:

1. Market Data Processing

The foundation of any quant strategy begins with analysing and preparing data, which includes:

- Numerical data: Historical price data, order books, financial statements.

- Relational data: Networked relationships between financial data and metrics.

- Alternative data: Text, images, or audio (e.g., news, social media sentiment).

- Simulation data: Synthetic datasets to supplement real-world gaps.

AI is used to analyse market data, create features (or factors) from this data, such as momentum, volatility, valuation metrics, and technical indicators, which are then fed into predictive models.

LLMs are being used for "instrumentation", transforming unstructured data like text and video into numerical data that models can use. For smaller desks, quality foundational data (fundamentals and historic pricing) should be prioritized over jumping straight into expensive alternative data.

In terms of data, the pipeline should not be left to a single individual. Even in small companies, someone should be accountable for data coherence and quality. From there, you can integrate the data into strategies. However, the temptation is to let a single person handle the entire process because it's now easy to do so. This can be risky in terms of quality and overlooking potential pitfalls.

- Matteo Campellone, Algorithmic Trading Conference 2025

Check out Quantra’s self-paced course on Feature Engineering by Dr. Ernie Chan.

2. Model Prediction

At this stage, models forecast future asset behaviour (e.g., price movements, volatility). AI is designed to capture key relationships:

- Temporal patterns: Using CNNs, RNNs, LSTMs, or transformers.

- Spatial patterns: Capturing interdependencies via self-attention or Graph Neural Networks (GNNs).

- Spatiotemporal interactions: Combining time-based and entity-based signals.

Models aim for either intermediate predictions (e.g., price direction) or end-goal optimisation (e.g., maximising portfolio returns).

Check out the modular learning track Artificial Intelligence in Trading which covers implementation of AI models such as RNN, LSTM, XGBoost, K-Means, DBSCAN Clustering on financial markets data; backtesting analysis and more.

For entrepreneurs, the highest returns are found in strategy design and alpha generation. To avoid alpha decay, specialized models targeting niche markets or languages are required.

According to Peter Cotton, alpha generation yields "quadratic" returns. Tucker Balch recommends that traders develop "specialized models" tailored to the specific market and industry they aim to profit from. Professor Balch also advises that for arbitrage strategies relying on clustering, recomputing clusters "monthly" is generally adequate for mean reversion to occur and offset transaction costs.

Insights from Algorithmic Trading Conference 2025.

3. Portfolio Optimisation

This step turns predictions into actual investment decisions by optimising asset allocation. While traditional techniques (e.g., Black-Litterman model) remain relevant, DL and Reinforcement Learning (RL) are increasingly used for capital allocation. RL is particularly suited for dynamic, goal-aligned portfolio management.

Two short courses on this topic:

1. Portfolio Optimisation: Hierarchical Risk Parity

2. Portfolio Optimisation: LSTM Networks

4. Order Execution

This final phase places trades to minimise costs and market impact. AI-driven order execution can process high-frequency data and can employ RL models to optimise order placement in real time, adaptively.

“(Machine Learning) is going to be viewed more and more like a tool that you use; just like EXCEL at some point became like a standard thing" - Stephen Jensen, March 2024, Panel Discussion on AI-Powered Trading

5. Alpha Generation & Market Efficiency

Research presented at the conference suggests that, over longer time periods, historical price data consistently outperforms AI/NLP methods in defining stock relationships, lending strong support to the Efficient Market Hypothesis (EMH). Therefore, new alpha must stem from novel thinking or truly new data

Building a stock portfolio involves understanding how stocks perform relative to one another, with price providing significant insights. Currently, AI doesn't fully exploit all available information in this regard. While some inefficiencies might still exist in high-frequency trading, they primarily require co-located servers to capitalize on. Therefore, the key takeaway is that success hinges not on the AI itself, but on the unique insights you bring to the table, a fresh perspective on data, a new angle, or entirely novel information. - Professor Tucker Balch, Algorithmic Trading Conference 2025

How is AI enabling more retail participation in algorithmic trading?

AI as a Coding Assistant: LLMs like Claude AI and ChatGPT are extensively used by individuals, even those with limited or no prior coding experience, to generate code for trading algorithms. These tools assist users in creating trading bots and giving trade ideas, making the process of developing automated trading systems more accessible. Users have reported success in building functional trading bots or components, suggesting a reduced barrier to entry for individuals seeking to generate trading ideas.

Sentiment Analysis: LLMs can also be utilised for sentiment analysis of news and social media, which can be integrated into predictive models.

Trading platforms are essential for AI-driven trading, offering tools to develop, test, and execute strategies. Many support the integration of Python and AI, featuring tools such as real-time data feeds, backtesting, and AI bots for signal generation and risk management. Some also offer no-code interfaces, making algorithmic trading accessible to non-coders.

Few insight from the Algorithmic Trading Conference 2025.

The barriers to entry have fallen due to decreased infrastructure costs and accessible prototyping tools.

Infrastructure Costs: The necessary infrastructure (like renting GPUs) has become significantly cheaper, making AI-driven trading accessible to small firms. Faisal Mohammed stated that costs have "significantly come down," estimating a startup budget for infrastructure and experimentation is "probably in the tens of thousands of dollars right now."

No-Code Platforms: These platforms are highly effective for rapid prototyping. However, they are useless without robust backtesting capabilities to prevent overfitting.

Tucker Balch advised that when evaluating low-code platforms, users must "ensure that it is something that you can backtest with."

Model Training Strategy: New entrants should utilize existing models augmented by RAG (Retrieval-Augmented Generation) for specific context, reserving full model training for a "stable setup."

Faisal Mohammed recommends that early-stage users "have to use an existing model, and you have to use some kind of an RAG so that the… AI does not hallucinate on its own."

Can I make money using ChatGPT or AI trading bots?

AI trading bots can struggle in real markets due to overfitting on historical data, unexpected market events, and their inability to adapt to changing economic conditions or irrational human behaviour.

There are crucial limitations and risks involved with using AI bots or ChatGPT without conceptual grounding that can impact profitability:

1. Risk of Overfitting: A significant challenge with Deep Learning is the risk of overfitting, which can lead to poor performance in live trading. Strategies generated or assisted by LLMs are particularly susceptible to this.

2. LLM Hallucinations and Illogical Results: LLMs can “hallucinate a lot and are very confident in their answers, which can be misleading,” potentially producing incorrect code or contradictory advice.

3. Martingale-like Strategies: Strategies assisted by LLMs can lead to “Martingale-like” behaviours that appear to have a high win rate by not closing losing trades, leading to accumulating “floating P&L” and the risk of wiping out the entire account in a single trade.

4. Data Quality and Cost: Relying on free data can lead to inaccuracies, and obtaining high-quality, granular data can be expensive, impacting the reliability of AI models. Thorough research is essential for selecting reliable data sources and evaluating trading strategies to ensure robust performance.

5. Numerical Reasoning Gap: LLMs currently exhibit deficiencies in precisely recognising price-volume patterns compared to specialised quant DL models.

6. Oversimplified Portfolio Optimisation: Current LLM frameworks often neglect sophisticated risk measures and assume frictionless markets.

7. Operational Limitations in Order Execution: Most LLM systems assume perfect liquidity, ignoring complex order book dynamics and market impact.

8. Model Explainability & Risk: A significant divergence exists between Peter Cotton and Dimitri Bianco regarding explainability risk in systematic trading. Cotton argued that this risk is "massively overblown" because it can be mathematically bounded (using the Cauchy-Schwartz inequality) by forcing the opaque model's output to stay within a small deviation of a simple, understood model. Bianco, however, countered that explainability is fundamental to finance.

Peter Cotton stated: "It is a strict falsehood to say that you need to understand what the model is doing, that it's just not true, right? It is mathematically false." Dimitri Bianco responded: "Explainability, I think, is the core of finance. Without it, you are not doing finance, you're not doing quant finance, I think you're just kind of gambling."

9. Systemic Risk (Tail Risk): If AI models become commoditized and concentrated (meaning similar large language models drive similar orders), the market could see enhanced large-tailed risks due to potential herd effects, as Matteo Campellone noted.

10. Regulatory Focus: Even as technology progresses rapidly, regulations often struggle to keep pace. However, the ultimate responsibility for a model's decisions continues to rest with human oversight.

As Prodipta Ghosh succinctly put it, the regulatory consensus centers on human responsibility: "‘The key idea is a responsibility... there has to be a human behind it who will be responsible for its decision. I think that is the core idea most of the regulators are going for’".

In summary, while AI offers significant potential for enhancing profitability through advanced analysis and automation in trading, its successful application requires careful consideration of its inherent limitations and risks, especially concerning overfitting and the reliability of LLM outputs.

“The ChatGPT and related GPT technology will probably be advanced to a state where discretionary trading might be more profitable by the agent!” - Dr. Ernie Chan, March 2024, Panel Discussion on AI Powered Trading

Therefore, to potentially make money with AI trading, an individual would need:

- Clear Trade Ideas: The ability to conceptualise a trading strategy, even if coding knowledge is minimal.

- Effective Prompt Engineering: Skill in crafting precise prompts for LLMs to generate desired code or analysis.

- Critical Evaluation and Verification: Crucially, the ability to critically review AI-generated code and results for errors, inconsistencies, and potential risks (like overfitting or Martingale-like behaviour). This involves understanding basic trading concepts and common pitfalls.

- Patience and Continuous Refinement: The process often involves “a nightmare of ups and downs,” requiring perseverance to “get everything set up correctly” and to “constantly keep checking/reminding your AI to stay on track”.

Free course on Introduction to Machine Learning in Trading

While AI tools like LLMs can lower the barrier to entry by assisting with coding, a solid understanding of Python remains highly beneficial for greater control, customisation, and the ability to diagnose and refine sophisticated trading systems, which is crucial when putting significant capital at risk. Brokers play a key role in enabling automated trading and connecting AI tools to the markets through their APIs and trading platforms.

"If you are doing this in practice, you want to be very, very good at programming... You need to be able to code very, very quickly and well" - Paul Bilokon, Sept 2024, Workshop on Reinforcement Learning

How QuantInsti's courses cover ML and AI

The EPAT (Executive Programme in Algorithmic Trading) curriculum makes a significant contribution to education on AI for trading by providing a comprehensive, practical, and industry-relevant pathway.

- Comprehensive Curriculum Structure and Content: EPAT is a fully online live classroom course offering over 120 hours of live training and approximately 150 hours of self-study content. Accredited by the Institute of Banking and Finance (IBF, Singapore) and Continuing Professional Development, UK, it aims to make algorithmic trading accessible to individuals from diverse backgrounds, focusing on both theoretical knowledge and practical application using real-world data and case studies. EPAT lectures are led by experts and practitioners who help students generate and refine their own trading ideas using practical insights and real-world applications.

- Specific Modules on AI: The curriculum covers key modules directly relevant to AI for trading:

- Machine Learning for Trading (Module 7): This central module equips participants to apply AI, particularly machine learning, in developing and implementing robust trading strategies. It covers:

- Foundations: Use of Python and Jupyter notebooks for feature creation, model building/evaluation, and performance testing, emphasising understanding of overfitting.

- Core Machine Learning Algorithms: Supervised Learning (Classification: predicting market direction, regression: predicting continuous values), including Decision Trees, Random Forests, Logistic Regression, and Support Vector Machines (SVM). Unsupervised Learning, such as clustering (e.g., K-Means for grouping assets). Neural Networks: Architecture, activation functions, training techniques (gradient descent, backpropagation).

- Natural Language Processing (NLP) and Sentiment Analysis: Highlights alternative data (news, social media), covering text preprocessing, vectorization techniques (Term Frequency, TF-IDF, Word2vec), Topic Modelling (LSA, LDA), and using Machine Readable News (MRN) for sentiment analysis in trading.

- Reinforcement Learning (RL) for Trading: Introduces RL where an agent learns optimal actions by maximising a reward signal, explaining deep RL to approximate Q-tables and emphasising reward function design and state feature selection. It also addresses RL limitations, such as overfitting and hyperparameter complexity.

- Statistical Arbitrage with PCA: Explores strategies using Principal Component Analysis (PCA) for dimensionality reduction, understanding abstract factors, and generalising strategies to portfolios.

- Data Analysis & Modelling in Python (Module 6): Focuses on practical Python skills, working with market data of different asset classes.

- Advanced Statistics for Quant Strategies (Module 9): Covers time series analysis.

- Portfolio Optimisation & Risk Management (Module 11): Crucial for balancing risk and return, covering risk types, industry-standard techniques (VaR, stress testing), risk-adjusted return metrics, and capital allocation.

- Market Microstructure for Trading (Module 4): Essential for high-frequency trading (HFT) roles, covering market mechanisms, order book dynamics, order types, algorithms, implementation shortfalls, and execution strategies to minimise costs.

Conclusion

In conclusion, while commercial applications offer automated AI tools, QuantInsti provides a comprehensive educational pathway. It teaches the underlying AI methodologies (machine learning, deep learning, NLP, reinforcement learning), quantitative finance principles, statistical foundations, and practical programming skills required to build, understand, and advance sophisticated trading systems.

From the insights of the Algorithmic Trading Conference 2025, we can conclude that the shift requires greater proficiency in leveraging AI within existing workflows, intellectual humility, and strong communication skills.

Evolving Skillsets: AI increases coding efficiency, so professionals must incorporate it or risk being outcompeted. Hiring managers value extreme open-mindedness and intellectual modesty.

As Professor Balch reiterated, "AI is not going to take your job. Someone who uses AI is going to take your job." Peter Cotton looks for "extreme open-mindedness."

Prompt Engineering: Prompt engineering is a legitimate and growing skill set, essentially viewed as communication. As Peter Cotton stated, prompt engineering "is essentially communication."

Solo Trading Reality: While it's possible for a solo trader to earn a living, it's significantly harder to maintain and scale competitively than working within a small team.

As Dimitri Bianco stated, "I think it's very hard to compete [solo]. I still stand by. I think that you need a team."

EPAT effectively bridges the gap between theoretical AI research and its practical deployment in the financial industry, enabling participants to contribute to the "forefront" of AI application in quantitative investment by understanding how AI can be used for tasks such as data mining, sentiment analysis, real-time analysis, predictive modelling, risk modelling, stress testing, backtesting, and benchmarking in trading.

Explore the entire EPAT curriculum or schedule a free counselling call to ask your questions: