What are EPAT Benefits?

Expert Faculty

An acclaimed team of subject matter experts

Dedicated Support

A Support Manager for each EPATian

Career Services

Lifetime placement and career assistance

EPAT features

Project work opportunity

Scholarships and Financial Aid

Lifetime access to latest course content

Verified Certification

Exclusive EPAT Community benefits

Credit Points for continuous professional development

120+

Hours Live Lectures

20+

World Class Faculty

300+

Placement Partners

90+

Participant Countries

EPAT Faculty

Dr. Robert Kissell

President, Kissell Research Group

Ex - UBS, JP Morgan

Brian Christopher

Founder and Researcher, Blackarbs LLC

Ex - Thomson Reuters

Dr. Thomas Starke

CEO, AAAQuants

Ex - VivCourt Trading, Rolls Royce

Dr. Yves J. Hilpisch

CEO, The Python Quants

Dr. Hui Liu

Founder & CEO, Creator, Running River Investment LLC & IBridgePy

Dr. Gaurav Raizada

Founder, iRage

Visiting Professor, IIM Ahmedabad

Rajib Ranjan Borah

Co-Founder & CEO, iRage

Visiting Faculty, IIM Ahmedabad, IIT Bombay

Ex - Optiver, PwC, Bloomberg

Anil Yadav

Systematic Trading Strategies, iRage

Ex - Lehman Brothers

Ashutosh Dave

Team Manager- Quantitative Research, Futures First

Ex - OSTC Ltd.

Ishan Shah

Lead, Research and Content, Quantra

Ex - Barclays, Bank of America Merrill Lynch

Jay Parmar

Quantitative Researcher, iRage

Ex - OSTC Ltd

Nitesh Khandelwal

Chief Executive Officer and Director, QuantInsti

Co-Founder, iRage

Ex - ICICI Bank

Nitin Aggarwal

Co-founder, Director, Alphom Advisory

Ex - Aditya Birla Group, BCG

Prodipta Ghosh

Vice President, QuantInsti

Ex - Deutsche Bank, Standard Chartered Bank, DRDO, Cognizant

Radha Krishna Pendyala

Data Scientist, Refinitiv

Varun Pothula

Quantitative Analyst, QuantInsti

Ex - Futures First, Accenture

Dr. Ankur Sinha

Professor, IIM Ahmedabad & Chairperson, 2-Year MBA (PGP)

Vivek Krishnamoorthy

Head - Content & Research, QuantInsti

Ex- ICICI Bank, Oracle, Infosys

300+ PLACEMENT PARTNERS

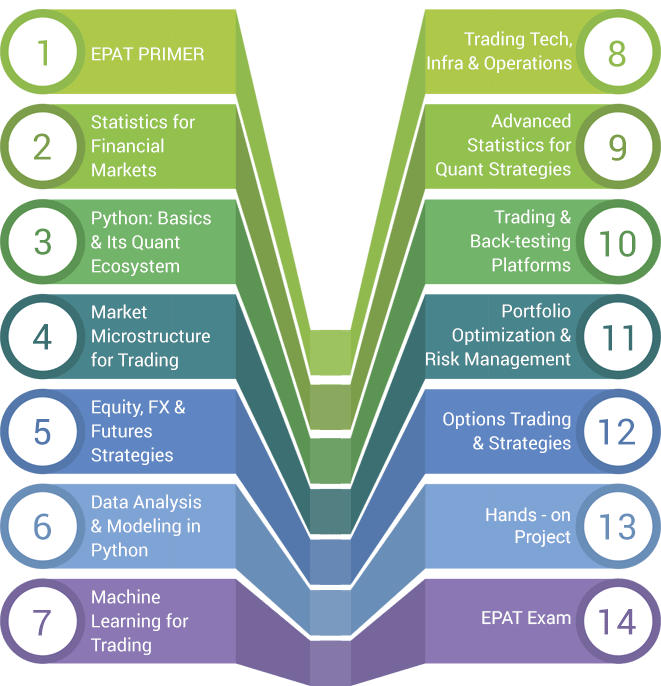

Curriculum

Certificate

This programme has been accredited by The Institute of Banking and Finance (IBF, Singapore) under the IBF Standards. IBF-STS provides upto 50% funding for direct training costs subject to a cap of S$ 3,000 per candidate per programme subject to all eligibility criteria being met. This is applicable to Singapore Citizens or Singapore Permanent Residents, physically based in Singapore. Find out more on www.ibf.org.sg

EPAT is accredited by CPD, UK (Continuing Professional Development, UK)

QuantInsti has registered this program with GARP for Continuing Professional Development (CPD) credits. Attending this program qualifies for 30 GARP CPD credit hours. If you are a Certified Financial Risk Manager (FRM®), or Energy Risk Professional (ERP®), please record this activity in your Credit Tracker.

Learner Reviews

We have a 4.8 rating out of 400+ Google reviews

ADMISSION PROCESS

Send your

Application

Get on a call

with a Counsellor

Application

acceptance

Pay the fee

and get started

Send your

Application

Get on a call

with a Counsellor

Application

acceptance

Pay the fee

and get started

Before admission, we will facilitate a one-on-one counselling session that will focus on understanding the strengths and weaknesses of the participant. These sessions do not necessarily decide the participants' eligibility but help counsellors assist them with informed guidance prior to enrollment.

Batches & Fee Structure

Super Early Bird Discount

Early Bird Discount

Standard Fees

Start Date

11th Apr 2026

Super Early Bird Enrollment Fees

7,799 (valid till 30th Jan 2026)

Early Enrollment Fees

8,599 (valid till 7th Mar 2026)

Standard Enrollment Fees

9,499 (valid till 3rd Apr 2026)

Start Date

12th Jul 2026

Super Early Bird Enrollment Fees

7,799 (valid till 30th Apr 2026)

Early Enrollment Fees

8,599 (valid till 5th Jun 2026)

Standard Enrollment Fees

9,499 (valid till 3rd Jul 2026)

Start Learning Now!

Batch 70

717/mo*

for 12 mo. at 0% APR

batch 70

start date

11th Apr 2026

Early Bird Discount

8,599 Valid till 7th Mar 2026

9,499

Valid till 7th Mar 2026

Participants have the opportunity to receive additional financial aid on top of existing discounted fees. Connect with us to check eligibility.