Quantitative Trading Course for Real-World Skills

Learn from the industry experts and become a certified quant trading professional

120+

Hours Live Lectures

13000+

Five-Star Reviews

20

World Class Faculty

300+

Hiring Partners

EPAT - Executive Programme in Algorithmic Trading

The Executive Programme in Algorithmic Trading at QuantInsti is a 6-month, globally recognized quantitative trading course built for professionals who want to transition into the world of quantitative trading and take on high-impact roles such as quant analyst, quantitative researcher, or systematic trading professional.

Whether you're from a finance, technology, or engineering background, EPAT helps you build real-world skills in Python-based strategy development, quant research, and automated trading systems, taught by leading global practitioners.

Throughout the programme, you’ll gain expertise in:

Strategy design and backtesting using Python

Financial modeling and portfolio optimization

Machine learning techniques for financial markets

Market microstructure, risk management, and trading infrastructure

Execution logic and algorithm deployment using APIs and real-time platforms

You'll also work with tools like Blueshift and IBridgePy to simulate and refine your strategies in a realistic trading environment.

By the end of the course, you’ll be equipped to:

Launch your own automated quant trading desk

Apply for roles like quant analyst, quant developer, or trading strategist

Join proprietary trading firms, hedge funds, or fintech companies

Confidently handle live data, backtesting, and strategy automation

With structured live classes, dedicated faculty mentorship, and a capstone project, EPAT prepares you to succeed in the competitive world of quant finance, whether you're just entering or upskilling in the field.

programme benefits

World-Class Faculty

Learn from the best in the industry

Dedicated Support

Get answers to all your queries super quick

Career Services

Avail lifetime placement and career assistance

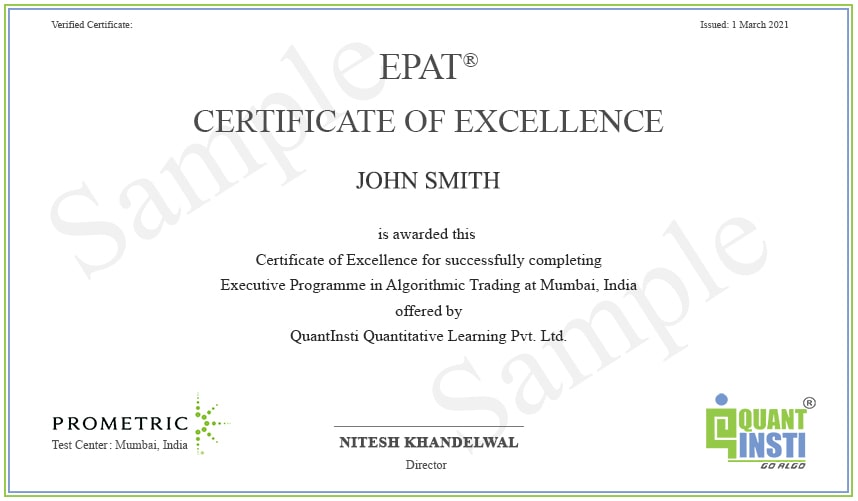

Certificate

EPAT is accredited by CPD, UK (Continuing Professional Development, UK)

EPAT is recognized by IBF, Singapore (Institute of Banking and Finance) under the FTS scheme

QuantInsti has registered this program with GARP for Continuing Professional Development (CPD) credits. Attending this program qualifies for 30 GARP CPD credit hours. If you are a Certified Financial Risk Manager (FRM®), or Energy Risk Professional (ERP®), please record this activity in your Credit Tracker.

Click to zoom

PLACEMENT PARTNERS

FAQs

EPAT offers a comprehensive curriculum that combines theory with practical implementation. It teaches you how to use Python, build and validate strategies, and apply statistical and ML techniques, exactly what employers seek in quant analysts and traders.

Without a programming background, can I still learn quant trading through EPAT?

Yes. EPAT is structured to support learners from both finance and non-tech backgrounds. The programme begins with a Python primer and gradually builds your coding skills alongside your understanding of trading strategies. By the end of the course, you’ll be able to code, backtest, and evaluate your own quantitative trading models using Python, even if you start with zero programming experience.

What kind of quant topics are covered in the programme?

EPAT covers both foundational and advanced topics required to build a career in quantitative trading. You’ll learn:

- Statistics, econometrics, and time series modeling

- Python programming for finance

- Strategy building and backtesting

- Portfolio optimization and risk management

- Market microstructure, execution logic, and APIs

- Machine learning for trading (including PCA, clustering, SVMs, random forests)

You’ll gain the skills to design, test, and deploy your own quant trading strategies using real-world tools and market data.

Will I be provided access to trading tools or platforms during the course?

Yes. EPAT includes hands-on access to institutional-grade trading platforms such as Blueshift, IBridgePy, and Interactive Brokers API. These tools allow you to backtest strategies, simulate trades, and gain practical experience in building and testing quant models, just like you would in a professional quant role.

What kind of certification is awarded after completing EPAT?

Upon successful completion of the programme and final exam, you receive the EPAT Certification. This certification is:

- Accredited by CPD (UK)

- Recognized by IBF Singapore under the IBF-STS scheme

- Eligible for 30 GARP CPD credit hours (for FRM®/ERP® holders)

Participants who excel also receive a Certificate of Excellence, which opens up additional funding and job opportunities, including the chance to pitch strategies to global trading funds.

What kind of career support is offered through EPAT?

EPAT provides lifetime placement assistance through:

- Resume building and mock interviews

- Job alerts and referrals from 300+ hiring partners

- One-on-one mentoring to help you apply for quant roles

- Support for setting up your own quant trading desk