Python based Algorithmic Trading Certification Programme

Learn from the industry expert and develop algorithmic trading strategies using Python

120+

Hours Live Lectures

13000+

Five-Star Reviews

20

World Class Faculty

300+

Hiring Partners

EPAT - Executive Programme in Algorithmic Trading

The Executive Programme in Algorithmic Trading (EPAT) is a 6-month, globally recognized algorithmic trading with python course built for professionals who want to learn how to develop algorithmic trading strategies using python, apply python programming in finance and quantitative modeling, advance in careers focused on quantitative finance, trading tech, or fintech

Whether you're a finance professional, aspiring quant, or a developer, EPAT gives you the skills to code, backtest, and deploy trading algorithms using real market data and industry tools. The programme is also ideal for those seeking a structured, career-focused python for trading course with live instruction, mentorship, and industry tools.

The programme covers:

Python programming for finance and data analysis

Quantitative trading strategies using python

Market microstructure and trading APIs

Machine learning and backtesting libraries

Automation and cloud infrastructure for trading systems

You’ll learn how to:

Build and test python trading algorithms

Apply models in real time using platforms like Blueshift and IBridgePy

Use python to structure risk-aware, data-driven trades

Explore portfolio management, strategy automation, and live testing

Understand the full pipeline of python for quant finance,from research to execution

With live weekend sessions, expert mentoring, practical projects, and a proctored exam, EPAT is the ultimate certificate program for algorithmic trading with python, designed to help you build a career in quant finance, system trading, or trading tech.

programme benefits

World-Class Faculty

Learn from the best in the industry

Dedicated Support

Get answers to all your queries super quick

Career Services

Avail lifetime placement and career assistance

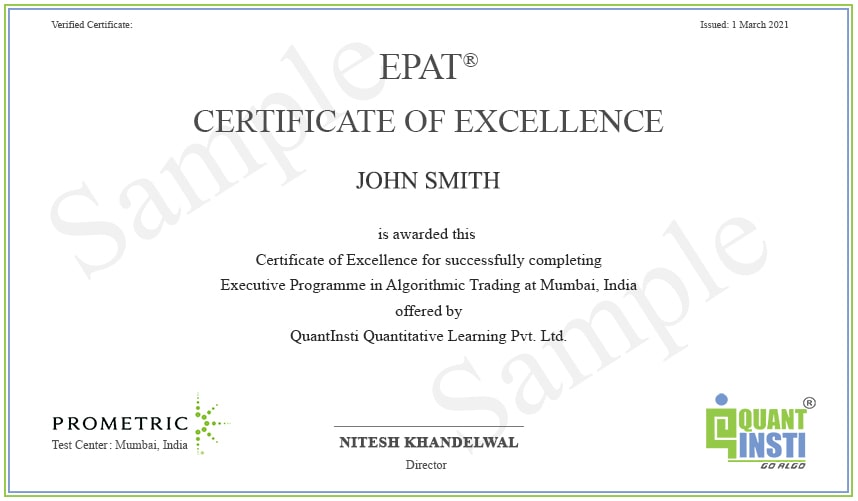

Certificate

EPAT is accredited by CPD, UK (Continuing Professional Development, UK)

EPAT is recognized by IBF, Singapore (Institute of Banking and Finance) under the FTS scheme

QuantInsti has registered this program with GARP for Continuing Professional Development (CPD) credits. Attending this program qualifies for 30 GARP CPD credit hours. If you are a Certified Financial Risk Manager (FRM®), or Energy Risk Professional (ERP®), please record this activity in your Credit Tracker.

Click to zoom

PLACEMENT PARTNERS

FAQs

Absolutely. EPAT bridges the gap between basic python and its advanced use in financial markets. You’ll learn how to turn code into strategy, including working with data, applying machine learning, and deploying python trading algorithms in real-time environments.

I don’t have prior coding experience. Can I still learn python for trading through EPAT?

Yes. The course starts with a python primer and gradually builds your confidence. You’ll progress from core concepts to writing your own algorithmic trading strategies using python, even if you’re starting from scratch.

What tools will I use to learn python for algorithmic trading?

You’ll work with:

- Blueshift – for backtesting and paper trading

- BridgePy & REST APIs – for live strategy execution

- Pandas, NumPy, matplotlib, scikit-learn – for modeling and analysis

These tools reflect the real-world tech stack used in python algo trading desks.

What python-specific topics are included in the programme?

Topics include:

- Object-oriented programming in trading systems

- Backtesting frameworks using python for quant finance

- Feature engineering and data wrangling

- ML-based strategy creation using scikit-learn

- Strategy deployment using API and cloud-based environments

You’ll also gain hands-on experience building quantitative trading strategies using python from scratch.

What roles can I aim for after this algorithmic trading with python course?

EPAT alumni go on to become:

- Quant developers and python trading engineers

- Strategy automation specialists

- Systematic traders and analysts

- Fintech consultants and quant product leads