Algorithmic Trading Course: Build AI & ML Strategies for Stocks & Finance

EPAT empowers finance professionals, coders, and traders worldwide to build successful algorithmic trading careers with practical AI and Machine Learning applications

What You’ll Learn

Algorithmic Trading with AI and Machine Learning Applications

Build algorithmic trading strategies using Python and real market data (including stock data)

Apply AI models in trading to develop intelligent, automated decision-making systems

Use machine learning trading techniques like random forests, gradient boosting, and support vector machines

Develop AI-driven trading strategies using neural networks, including RNN, LSTM, and CNN

Apply natural language processing (NLP) and AI-based sentiment analysis to leverage alternative data from news and social media

Learn core algorithmic trading areas such as electronic market-making, derivatives trading, risk management, and trading technology

120+

Hours Live Lectures

13000+

Five-Star Reviews

20

World Class Faculty

300+

Hiring Partners

EPAT - Executive Programme in Algorithmic Trading

The Executive Programme in Algorithmic Trading (EPAT) at QuantInsti is designed for professionals planning to start their own trading desk and those looking to grow in the field of Algorithmic and Quantitative Trading.

The program equips you to enhance automated, AI-driven trading. Learn to build and deploy sophisticated strategies for high-frequency trading, day trading, and long-term investments in the stock market and other financial instruments. The program also equips you to apply AI and Machine Learning techniques in trading, helping you build future-ready strategies.

EPAT helps traditional traders, coders, and finance professionals successfully transition into automated algorithmic trading by covering core strategies, trading technology, derivatives, quantitative trading, electronic market-making, and risk management.

programme benefits

World-Class Faculty

Learn from the best in the industry

Dedicated Support

Get answers to all your queries super quick

Career Services

Avail lifetime placement and career assistance

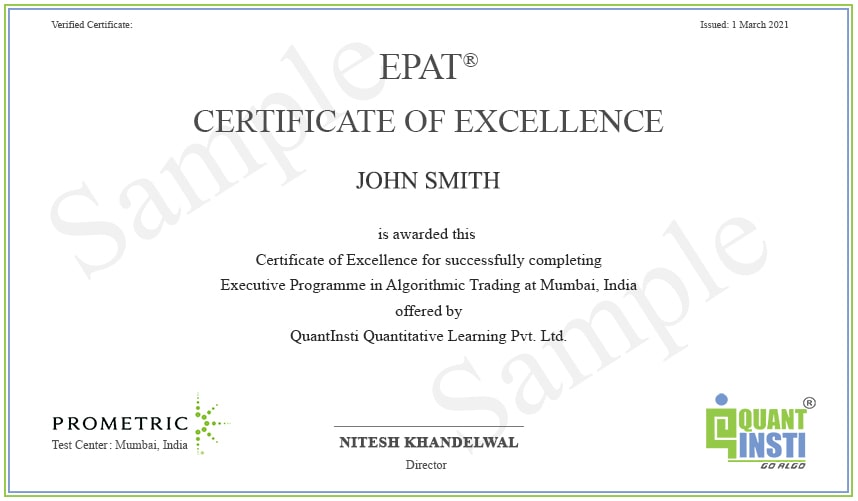

Certificate

EPAT is accredited by CPD, UK (Continuing Professional Development, UK)

EPAT is recognized by IBF, Singapore (Institute of Banking and Finance) under the FTS scheme

QuantInsti has registered this program with GARP for Continuing Professional Development (CPD) credits. Attending this program qualifies for 30 GARP CPD credit hours. If you are a Certified Financial Risk Manager (FRM®), or Energy Risk Professional (ERP®), please record this activity in your Credit Tracker.

Click to zoom

PLACEMENT PARTNERS