Tesla crossed $500 on January 13! The market valuation of Tesla actually surpassed $100 billion and beat Volkswagen and GM to become the second most valued auto maker. However, if we looked at the number of cars manufactured, there is a huge disparity between Tesla and the other top auto makers. Thus, we are bound to think whether it will sustain this price level or turn out to be a bubble? Are you prepared for it?

What if you think this price is not sustainable and it will crash sooner than later. Let’s say you have analysed quite a few companies in the past and like the others, Tesla will shave off a few points and return to a normal level. Can you use this information in the stock market somehow?

If thoughts like these came to your mind, congratulations, you are already thinking about short selling.

We will cover the following points in this blog:

- What is short selling?

- How does short selling work?

- Short selling example

- Things to keep in mind while short selling

- How do you borrow a stock to short sell?

- The long-short strategy

- Is short selling ethical?

- Other Myths

What is short selling?

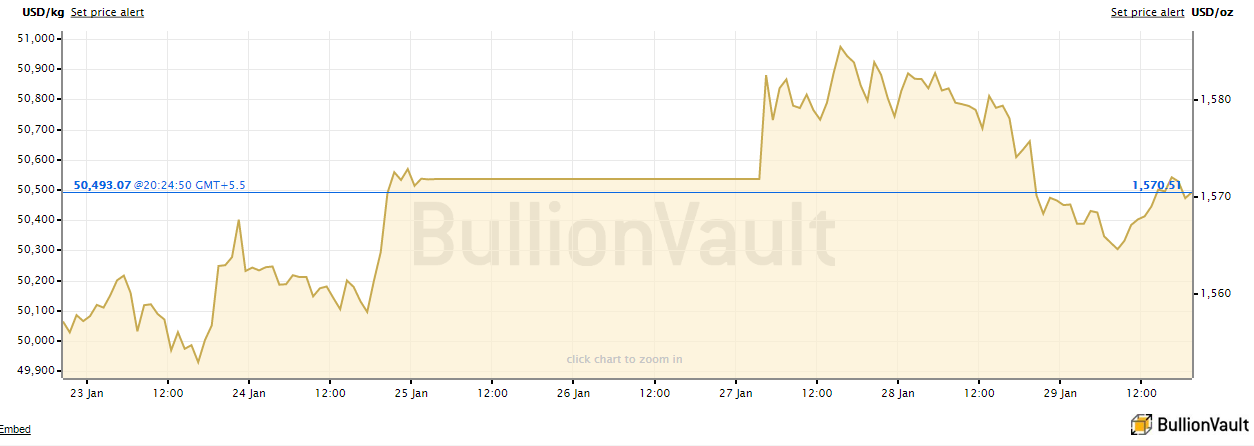

Let’s try to understand short selling by taking an example of gold. For reference, let us see the price of gold in the last month.

Source: BullionVault

You are just analysing the gold price for the past month and feel you have recognised a pattern. You zoom in and see the weeks forecast now ie 23 January to 29 January 2020.

Let’s say, as of 24 January, 2020, the price of Gold is $50,514. but you feel that in a few days, it can reach less than $50,400. Now your acquaintance wants to buy gold today itself. So, you borrow gold from one shop owner and sell it to your acquaintance. Now you have $50,400 but you still have to give a brand new phone to the shop owner. Luckily, the price of gold reduces to $50,304 on 29 January, 2020 and you eagerly buy gold (from the open market) and return it to the shop owner you had borrowed from.

Let’s see what happened here.

- Your acquaintance wanted to buy gold and got it at $50,514. Acquaintance satisfied.

- The shop owner lent gold and got it back from you (probably got $10 for the same). Shop owner, satisfied.

- You sold gold at $50,514 but had bought it for $50,304. Subtract $10 you gave to shop owner and you get $200 profit. You are more than satisfied!

This is a very simple way to understand short selling. Depending on who you are, everyone is satisfied with this transaction and they will go about their life.

This video by Quantra explains Short Selling in under 2 minutes, do have a look:

Let’s move on to the heart of the matter in the next section.

How does short-selling work?

In the same format as the previous comparison, we illustrate the process in the following steps:

- Borrow the stock - Usually, a trader will borrow stock from the broker with a guarantee that they will deliver the said stocks in the future. Here, the trader would have to look at different charges which are issued so that you are allowed to short stocks

- Sell the borrowed stock - The trader will sell the borrowed stock to a buyer at the current market price

- Buy the stock at a lower price - Depending on the agreement, the trader will then wait till the price of the stock goes down so they can buy the borrowed stock and pocket the difference. We call this, “closing the short position”

In the US markets, your broker will take care of the borrowing and lending part. You can short the stocks with a click of a button. We have understood that explaining a concept with an example is the best way to go about it. Thus, we will take an example and explain short selling now.

Short selling example

As we said at the start, Tesla reached $500 on January 13. There were a couple of reasons for it charting new highs, which include a promising future for Tesla in China as well as the Chinese government’s subsidy for electric vehicles made locally in China. But you believe this bull run won’t last long and the stock will come back to normal.

Let’s see the data on January 13. Tesla closed at $524. You decide to short sell the tesla stock the next day. 14 January comes up and what do you see?

Tesla Inc. (TSLA) has opened at $543.76. You decide that this is the best time to short 100 stocks ie sell 100 stocks of Tesla by borrowing it from your broker at a charge. You find a buyer who thinks Tesla will obviously increase.

Thus, you sold 100 stocks at $543.76 which gives you $54376.

That’s a big number! But this is just part 1 of your plan. Now you have to make sure that you buy 100 shares of Tesla and return it to the broker.

Let us now see the cost of being allowed to carry out short selling. Usually, you need to have a margin account which has a certain percentage of the transaction amount as a collateral. Depending on your region’s regulatory authority, it could be anywhere between 20% - 50%.

For our example, let’s say you have a 25% stipulation. Thus, when you shorted 100 stocks at $54376, you would have to keep $13594 in your margin account. Further, since you are actually “borrowing” the shares, you would have to give an interest for this. Think about it, why would the broker allow you to borrow shares if they are not getting anything. Apart from that, there can be transaction charges and brokerage charges as well.

To keep it simple, you see that you will be charged $100 for short selling the Tesla shares.

And now we wait!

Well, you will now see the stock price and if your analysis is correct, the stock price should go down.

At 12 pm on 14 Jan, you see that the Tesla share price has dropped to $531.74 and you place an order to buy 100 shares which get fulfilled immediately. Yayy! But how much did you make?

Simple, $531.74 * 100 = $53174. Subtracting this amount from the sale price, ie $54376 gives you $1202. You pay all the charges and interest, which totalled $100 and you net a profit of $1102.

That’s not bad, right?

Of course, we are looking at the bright side where your prediction was spot on and you were rewarded for it. Sometimes the stock price can increase too which would lead to a loss for your transaction.

By the way, since we were talking about Tesla, you have to know that it is one of the most shorted stocks in the US. And depending on the times, short-sellers have been known to win or lose big when it comes to shorting Tesla. Thus, you should know when to exit the trade too.

I hope this example helped clear all your doubts about short selling. If not, you can always comment on which aspect you would like me to speak more about. Now let us head on to the next section where we try to look at the big picture of short selling.

Things to keep in mind while short selling

Let’s say you have analysed a few stocks and zeroed in on one interesting stock to short. Now what?

Well, the first thing to check is how much demand is there for the stock. Think about it, if nobody wants to buy the stock, why would you short it?

The second thing, as I said earlier, you should know when to exit. Both in terms of high and low of the stock.

Taking our example, if you were short selling the Tesla stock while it was priced $543.76, you should keep a figure in mind when you would exit the trade if the share price increases. For a volatile stock like Tesla, the price could increase rapidly in a matter of hours, if not minutes. Most of the time, your broker closes the trade if your margin account is not able to keep with the minimum requirements, thus, keep a look on the account balance too.

This is called a short squeeze, where the short sellers have to close their positions due to a rapid increase in the price of the stock. This causes the stock price to rise even higher as the short sellers have to buy from the market.

For the third point, make sure that you know all the charges associated with short selling a stock. Depending on the region, your broker and the regulatory authority might have different restrictions and rules for short selling.

Another point to be mentioned is that between the time you short the stock and close it, if the company issues a dividend, then you would be responsible for transferring the said dividend to the concerned person. The reason is that the broker only lends the stock and thus any dividend is the short seller’s responsibility.

Of course, we haven’t covered all of them but these are some of the factors which you should take care of while you are short selling.

Great now you have the basic idea in place and some would actually want to go ahead and start short selling. But maybe you are still confused about stocks borrowing.

How do you borrow a stock to short sell?

Let’s take a small example before we move to the real answer. Let’s say you need a small loan of $10,000 for some reason. You go to a bank and apply for a loan. Now, the bank itself doesn’t exactly have money. So it takes the money from the deposit accounts of other individuals and loans you the amount.

Since the bank is providing you with the money, it charges interest on the loan amount. You agree to pay 5% interest and thus, after a certain period you return the money and the interest. The bank keeps the interest and puts the money back into the depositors’ account.

In a similar manner, when you are short selling a share, you approach your broker and put in a request for the number of shares you want. Usually, the broker has an arrangement with their clients or takes some shares from other accounts and lends them to you for a certain interest. Usually, it is taken from an individual’s margin account.

Once you receive the shares, you can sell them to a buyer whenever you receive a buy request. Of course, depending on the region you are in, the time frame you are allowed to borrow the shares can vary greatly. For example, in India, you are supposed to settle the account by end of the day, ie if you have shorted stock in the morning, you should return the shares to the broker by end of the day, irrespective of the price of the stock. In contrast, the U.S. does not have a limit, as long as the short seller’s margin account has sufficient balance.

Of course, not all stocks are available for shorting every time. Sometimes the brokers do not allow certain stocks as they are either shorted heavily or there is non-availability of shares in the open market.

Great! We are getting deeper into the short side now. By now we have understood how the process works and who are the different players in the short-selling game. But how do you play this game?

Well, if you are an individual who knows about buying stocks and has never tried short selling, you might think that short selling is a mirror of going long. Not true, according to Laurent Bernut, who has been a short seller for 18 years. He believes that if you go with the same mindset as a long, it would be disastrous as there is a different way to approach short selling.

One common myth is that sometimes you see stocks which look overvalued and are still soaring for quite some time. To short these stocks without sound analysis could be disastrous, a prime example being, Tesla.

Ok that is enough theory, let’s cover one of the strategies

The long-short strategy

This is one of the famous strategies which states that you should buy the outperformers and sell the underperformers. Sounds simple, right? It actually is. Since we are learning about short selling here, let us concentrate on the underperformers now.

How to identify underperformers?

The concept that the underperformers are the ones whose price seems to fall faster than gravity is somewhat misleading. In the course on short selling, it is stated that there are some factors you look out for when it comes to underperformers.

First, the underperformer starts falling in relation to the competition. Then it will fall below the industry/sector in which it operates in. If we go further, you will see that it will start underperforming the index and finally, it starts falling in absolute value.

Thus, in the short-selling side, you are not exactly looking for the right time of “High” and “low”, but instead focus on defining the sector, competitors etc for your stock universe.

Of course, what I said above was an oversimplification. In reality, short selling is executed by seasoned veterans and is comparatively riskier than the long side.

Initially, we start with regime definition, ie trying to understand if the stock is a buy or sell, whether it is in bull or bear market. Usually, a technical analysis which could include but is not limited to breakouts, moving averages or higher highs/lower lows is done.

For the higher highs/lower lows model, the concept is simple, if the stock is posting higher highs, then it is likely to be an outperformer. Whereas, if it is consistently posting lower lows, then it means that it is underperforming the market.

Once we have identified the underperformers, we will go ahead and short the stocks. As we have said before, once you place the trade, you will need a lot of patience to weather the storm that is the trade going against you for a temporary period before it goes in your favour.

Well, this was a pretty short explanation on how short selling differs from the long side. We have covered a lot of things in this article, but we didn’t exactly touch upon one thing which is the common question people ask when the topic of short selling comes up. Let’s discuss that in the next section.

Is short selling ethical?

Yes, it is. In fact, regulatory bodies the world over have agreed that short selling is an integral part of the trading landscape as it helps keep companies in check. Soren Aandahl is one of them. In his time at Glaucus Research Group as director of research and CIO, he has reported 28 cases of opinion reports stating his reasons to short the selected companies. The market always reacted to the reports and some companies were charged for misrepresentation too. Not only was the market made aware of the true nature of the companies, but it was also reported that his investments returned 51% compared to a negative 4% of the short community.

In fact, if we take the example of short selling in India, SEBI (Securities and Exchange Board of India) had banned short selling in 2003 but later lifted the ban. Initially reserved for retail investors only, it opened short selling to mutual fund houses and institutional investors as well in 2007. In the discussion paper, SEBI maintains that short selling is a legitimate activity which adds value, rather than manipulates the market.

These are just some instances where the markets over the world have embraced short selling and consider short selling as a counter to companies who try to inflate their valuations. I guess we have pretty much, covered everything when it comes to short selling. If you are more than intrigued about the world of short selling, you can check out Quantra’s short selling course which covers a lot of concepts as well as strategies which can be used for shorting stocks.

Let’s list down a few myths in the next section of the article.

Other Myths

Short sellers are blamed for a lot of things, ranging from destroying companies, the market and also the individual investor. The truth is short selling and long buying are two sides of the investor’s coin, both are important.

It is said that short sellers destroy value by bringing down the price of the stock. Actually, taking our example of short selling Tesla, the $1102 profit you earned is similar to the investor who bought 11 shares at $440 and sold them a month later at $540 to earn a profit of $1100. Both scenarios happened in the same month and thus we can say that Tesla kept its schedule of manufacturing cars.

Another point regarding the individual company is that when it comes to regulated markets, there is only a percentage of stocks which are allowed to be shorted, usually between 10 -30% of the available float. If the volume of stocks which are shorted breaches this level, the broker will automatically remove it from the pool of available stocks to be shorted. Thus, the fact that short sellers can bring down the entire company is misguided.

Zooming out from the company point of view to the entire market, we have all heard of large investors announce their investments as well as forecasts. Sometimes, this can be used as a way to offload one's own stocks. While this is common place, not many investors come out to issue statements about the stocks they are shorting. This is because short sellers are heavily audited. It is relatively hard to bring down the market sitting on the short side of the table.

When it comes to the economy, you will find that the strict regulations around short selling makes it extremely difficult to manipulate the market and in turn the economy.

Another myth is that we should only short during the bear markets. This can be detrimental as you will have a lot of competition once a sizable number of investors are trying to short stocks. Thus, practicing the short selling craft during a bull market will make it relatively easy to outperform the competition when the bear market arrives.

These are just a few myths we have touched upon in this article. If this doesn’t whet your appetite, you can always check out the following link for more such myths.

Conclusion

Short selling has evolved from being considered evil to a potentially lucrative style of investing if done right. We also saw how short selling happens in the real world and also a simple strategy to identify stocks which could be shorted. By the end, we also discussed how short selling helps the market, instead of affecting it negatively.

Disclaimer: All investments and trading in the stock market involve risk. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. The trading strategies or related information mentioned in this article is for informational purposes only.