By Chainika Thakar, Punit Nandi and Rekhit Pachanekar

Financial markets are generally unpredictable. Hence, you need to be prepared to deal with the uncertainty to avoid losing a lot of money!

Well, there is a way to not get directly involved in live trading using real money, and that is done through virtual money. Virtual money, in this context, is money which cannot be transacted in the real world but can be used for placing paper trades.

Paper trades are those where one can buy or sell securities without risking any real money. This mechanism of virtual money for placing paper trades is known as “paper trading.”

Paper trading is beneficial for beginners who want to learn how to trade in the financial markets and also for experienced traders who want to test their trading strategies without risking any real money, as mentioned before.

It serves as a platform for learning to trade practically and tests the capability to handle situations when the market direction is moving against the initial position taken.

In this article, we will go through the concept of paper trading and how it is a better way to test your strategies before deploying the strategy in the live markets!

This blog covers the following:

- What is paper trading?

- Why is paper trading important?

- Psychology of paper trading

- Skills required for paper trading

- How is market microstructure relevant for paper trading?

- How is backtesting useful while paper trading?

- Live trading vs paper trading

- How to do paper trading?

- Pros of paper trading

- Cons of paper trading

What is paper trading?

A paper trade allows investors to practise buying and selling financial instruments without risking real money. With paper trading, aspiring traders would practise on paper (or virtual money) before risking money in live markets.

Why is paper trading important?

Paper trading is important because:

- Paper trading allows investors to practise buying and selling securities without involving real money.

- Paper trading can test a new investment strategy before employing it in a live account.

- Paper trades teach novices how to navigate platforms and make trades but may not represent the true emotions that occur during real market conditions.

Let us now discuss some of the reasons that traders prefer, on an individual level, to paper trade and these reasons are as follows:

Confidence building

Let’s say you have backtested a strategy, and it looks fantastic. 400+ per cent returns in 3 years. The drawdown of 50% is a bit problematic, but then the 4 times returns are enough to make you say that this is a good strategy.

But a small part of your rational brain asks if it is a good strategy.

Can we do something else to build your confidence?

Paper trading is perfect for this situation. You are using the strategy on live data, but it is not your real money. Thus, you will understand if the strategy works in the live markets and gain the confidence to take the strategy live.

Checking deployment issues

Another advantage of paper trading is that you will understand how your orders are getting filled and if there is slippage. Also, you will get to know the trading platform and how it works.

Any bug over here can be identified and worked on so that you can deploy the strategy in the live markets without any hiccups.

Checking if the strategy performs as per expectations

Is the strategy which gave an annual return of 40% performing as expected in three months in the paper trading environment?

In paper trading, you can keep track of the trades and check if the strategy performance is in line with the backtesting results.

Understand yourself

While paper trading helps you understand the market. It also helps you understand yourself. You know that fear and greed can drive your decision-making process and should be kept in check. Let’s take an example here.

This is the price graph of Apple. Or rather, the split-adjusted price graph of Apple. Let’s say you invested in Apple at $50 in May 2019. And you were amazed when it crossed $80.

But then the price started falling in February 2020 due to the Covid-19 pandemic. A freefall from $80 to $56 in barely a few weeks. Holding on to your position in such a scenario would be difficult.

Of course, the price of Apple not only bounced back but touched $140 in 2021. This example illustrates that when your real money is on the line, it is hard to stay in a position that is declining sharply.

Psychology of paper trading

There is a famous quote, “It’s business, leave your emotions at the door”, from the movie - The Wolf of Wall Street. While this quote points out the eternal truth in the Financial Markets, traders more often get caught emotionally during live trading sessions.

Although paper trading provides a great platform for testing trading strategies beforehand, there are a few points that a novice trader should keep in mind before proceeding with it:

Virtual trade mindset

Since paper trading is a platform that uses virtual money to trade.

There can be a psychological barrier in a trader’s mind that:

- He/she is using virtual money and

- Whatever position has been taken therefore has zero possibility of losing real money

Therefore, rather than using this platform to enhance trading skills, it becomes a platform for taking long and short positions without serving its real purpose.

Therefore, you must always keep in mind that even if paper trading uses virtual money, seriousness while trading is extremely important to extract intrinsic value. You should always trade, thinking it is your real money on the line.

Decision making

Following the point of virtual-trade mindset, the issue of up-scaling capital is very prevalent in paper trading.

For example, when the direction of an equity stock’s price moves against the initial trade’s position in live markets, a trader usually would think multiple times before putting more money in the initial position.

However, since paper trading uses virtual money, a novice trader can further buy/sell the same equity stock to supplement the initial position. This creates a huge difference between paper trading and live trading.

This makes it essential to be aware that trading is based on tough decisions, and the platform of paper trading should be used wisely to inculcate that skill.

Initial capital

While risk is the probability of losing money while trading in the markets, this psychological parameter is very prevalent among traders. Fear and greed are the main components of market sentiment which is and will always exist in the financial markets.

When a trader uses paper trading platforms, a mindset to acknowledge the risk associated with the markets should be factored in. Your capital should be equal to the capital you would have invested in the live markets.

If you are planning to invest $10000, then it doesn't make sense to have $1 million in your paper trading account.

Build a realistic portfolio

It is easy to buy 1000 shares of Apple on your very first paper trade. However, in reality, there are very few chances that you would be taking a long position in 1000 shares of Apple in the very first trade using real money. Thus, build a portfolio which is similar to the one you would build using real money.

Risk management techniques

Paper trading serves the purpose of learning risk mitigation techniques in the Financial Markets. Using risk management techniques, you can easily curb your losses which might hamper your profits on a bad trading day.

There are market factors which have a significant impact on the profit margins for a trader. For example, the concept of stop loss or take profit may look very lucrative and perfect theoretically. However, when we try to set the stop loss or take profit parameters, there are multiple factors to consider.

This may be the stop loss value, the trailing stop loss value or even the take profit margin. Once we trade in the markets, if the underlying asset price moves as per our prediction, we tend to increase or decrease stop-loss as the case may be.

This whole dynamic mechanism of increasing or decreasing stop-loss and the take-profit parameter is an essential skill for a trader and can be optimised using paper trading.

Understanding market sentiment

Similar to live trading, asset prices move in accordance with market events in paper trading. For example: Generally, whenever there is an earnings announcement to be made by a company, markets usually tend to be volatile.

A novice trader can take a position after understanding the market sentiment and can trade thereon. Even if the markets do not move in the expected direction, he/ she can learn the impact that the news has on the markets.

This experience over a period of time gives a strong mental hold-up for taking positions in the live markets. This whole process inculcates confidence in the trader to create strategies and execute them after logically analysing the whole situation at that point in time.

Check metrics regularly

To get the most out of paper trading, you should check the performance of your strategy regularly. This will help you understand how well it performs and give you the confidence to go live or shut everything down.

Discipline

While trading can feel like a battle, the key to success always remains in holding your nerves tight under challenging situations. Discipline in trading can only be built through practice and a set of smart rules.

For example: Setting the stop loss at below 2% of the current levels or taking profit at 2% above the current market levels is easy. However, when the price of an asset falls or rises to the stop-loss or take-profit levels, a trader might change the margins to lose less or earn more profits.

Therefore, in order to handle situations like the one mentioned in the example, one should be disciplined and emotionally neutral. This habit is built over the years, so anyone in the financial markets can use paper trading to build trading discipline.

Reinforcement learning

While trading in the financial markets using virtual money, one makes mistakes in taking incorrect positions, incorrect trade order size for a position, or even the timing of the position.

These mistakes help us understand the market better and how it reacts in different situations. Therefore, paper trading acts as a reinforced learning platform for the traders while testing a new strategy or even after testing a modified strategy.

Skills required to do paper trading

Since you paper trade to get a fair idea of the potential profits and losses with your strategy, you need the same skills as you do for live trading. In paper trading, you do not deal with real money, hence, you do not lose real money.

“Not losing real money and yet gaining the exact experience of live trading” is the biggest advantage that paper trading brings to you. Therefore, the skills remain the same for paper trading as they are for live trading, and these are as follows:

- Quantitative analysis

- Python

- Backtesting

- Machine learning

- Risk management

How is market microstructure relevant for paper trading?

When you start to trade, there are a lot of factors you have to consider, or it could hamper the entire strategy, however good the trading strategy is!

Market microstructure plays an essential role since knowing about the same helps the trader learn about some market nuances. We have mentioned below some of the market nuances which can be mastered using paper trading:

Type of Order

Market order is a type of order where you place your trade order at the market price or the last traded price. On the other hand, a limit order essentially means placing the order at a fixed price.

Suppose instead of placing a market order, you place a limit order. In that case, there is a high probability that the trade might never be executed and all your hard work might go into vain as the current trading price may never hit the limit order price.

Using paper trading, the skills required to learn such market microstructure nuances can be sharpened, which is clearly an advantage during live trading, which involves risking real money!

Other types of trade orders include:

- Good till Cancelled(GTC) and

- Immediate or Cancel orders(IoC).

In GTC, the trade order is executed if completed or else cancelled. In IoC, the trade order is immediately executed either in full or a portion of the total quantity of the order. The unfilled or unexecuted orders are immediately cancelled in the IoC order type.

Application of theoretical concepts

There are multiple strategies which might look to be lucrative and would make perfect logical sense to implement in the live markets but in reality, they might work differently than what was initially expected!

For example, options strategies: covered call and naked put are more or less the same theoretically. However, the strategies perform slightly differently when we trade live in the markets.

The covered call strategy involves holding the underlying asset. However, the naked put doesn’t. This is why the payoffs can be very different from each other, leading to a difference in break-even points, even if both strategies involve selling options at the same strike price with the same current market price.

How is backtesting useful while paper trading?

Let’s take a look into some points where backtesting is useful for a realistic feel while paper trading. The points mentioned below will give you an idea of how backtesting differs from paper trading.

Also, we have discussed below how backtesting should be done for different reasons before you trade for creating a successful trading strategy and how the trade-related decisions are strengthened by backtesting:

Overfitting

Whenever you test a new trading strategy using the same parameters as the one to be deployed in the live markets using historical data i.e. past OHLCV data, the entire process is known as backtesting.

However, when we test the trading strategy, there is a probability of overfitting the historical data.

Overfitting means that you will modify the parameters of the strategy in such a way that the profit margins look absolutely perfect and overwhelming!

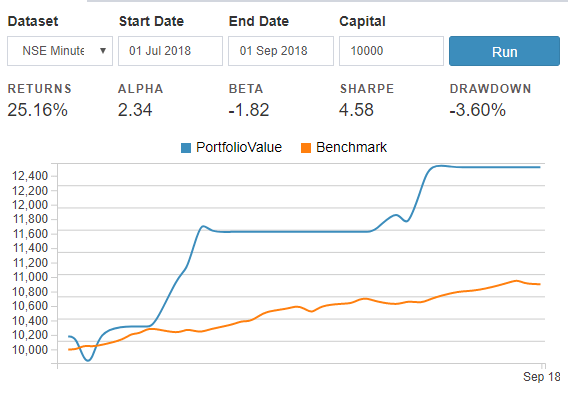

Take, for example, the below-mentioned backtesting result.

Backtesting Results - 01-July-2018 to 01-Sept-2018

The returns graph is for a pair trading strategy using the Indian stocks of TATA Motors and TATA STEEL, which have a high correlation value as they are part of the same conglomerate TATA Group. Two months of historical data with the implemented strategy gives a return of 25.16%.

However, if on the day of 01st September 2018, you had used the same strategy and deployed your capital live in the markets for the next year, the return results would have been a lot different than what you would have expected!

Backtesting Results - 01-10-2018 to 01-10-2019

This uneven backtesting result of 25.16% for the first backtest was because TATA STEEL had strong positive sentiment as it had doubled its net profit margins for Quarter 1, given its strong Europe Sales.

On the other hand, TATA MOTORS had strong negative market sentiment due to falling car sales data, and the impact of the Kerala Floods had further depleted TATA MOTOR’s stock price. This unusual net profit result was received using a Pair Trading Strategy, where the prices are expected to reach their mean price levels.

On the other hand, for the next year, the prices did not move far away from the mean prices, which generated only returns of 19.39% for the second time period.

Using paper trading, which simulates live trading, there is no scope to use price data in a way that would showcase outlier results as paper trading uses live data, which keeps flowing in and is not static.

Modifying parameters

While backtesting involves only testing the trading strategy based on parameters and observing if the trading strategy would work in live markets or not, it does not really involve trading using live data.

In paper trading, we are using our strategy on live data, and there is little scope to change the initial parameters. Thus, you can see whether the parameters you set will generate the expected returns.

Live data

Paper trading involves deploying the trading strategy in the financial markets using live data. Unlike historical price data, live data is a surprise to the human eye and an element that cannot be controlled or manipulated during the entire trading day.

However, in backtesting, the back tester has already seen the historical price data, and the element of surprise is lacking. Now, this element of surprise and how we react to the market data makes a good trader, a great trader!

Slippage and commission

Slippage generally means the difference between the execution price and the entry or exit signal price for a financial instrument. While Backtesting does not consider the occurrence of slippage while providing results, paper trading provides real-time experience to get acquainted with slippage costs.

Similar to slippage, commission cost is another variable cost associated with the execution of trades. Even though commission costs can be added to the historical prices before backtesting the strategy, there are still chances of a spread between the commission costs included and the actual commission costs for the trades.

Therefore, paper trading helps understand these factors and overcome these minute difficulties while trading live using real cash!

Live trading vs paper trading

Now, let us see the difference between live trading and paper trading. Paper trading is a great way to familiarise yourself with the market microstructure or how the stock market works. However, it may provide a false sense of security. It does not conform with the actual market because it lacks the risk that comes with real money.

Ultimately all your paper trading efforts should prepare you for the move into live trading. Live trading should be a profitable venture as long as you operate cautiously, taking note of your failures and successes.

Whether you’re a professional trader or a new trader, starting with a paper trading account and then switching to live trading will provide immeasurable benefits.

How to do paper trading?

Paper trading can be done in two ways that we have mentioned below, and these are:

- Paper trading platforms

- Paper trading games

Paper trading platforms

Paper trading platforms are either technology companies or online brokers. They either provide paper trading in the format of a virtual game or the general way of providing a paper trading account in complement to a real trading account.

The major difference between online paper trading broker platforms is the experience they provide to a trader and the facilities provided by them. Now, let's take a look at some known paper trading platforms. All these trading platforms

Interactive Brokers

Interactive Brokers (IB) has a fantastic paper trading platform to get started with your virtual trading experience. It has all the tools ranging from real-time charts, technical analysis tools, option pricing analytics, etc.

Anyone can start with a USD 1,000,000 virtual cash with an option of resetting the cash equity position at any time. The key differentiator for IB is its simple market news and data platform coupled with its excellent trade execution success rate.

However, there are certain limitations like non-execution of certain strategies, for example - VWAP. Also, it provides only level 1 data, i.e. limited order book data for paper trading and a market lag of 10-15 minutes, depending on the asset class. However, the biggest advantage of Interactive Brokers is its support for automating your strategies.

One can easily automate the strategies using Interactive Brokers.

TD Ameritrade

Paper Money by TD Ameritrade is also a very efficient online broker platform for paper trading. Ittoo, by TD Ameritrade, doesn’t charge any fee.

The issue with TD Ameritrade is that it only allows customers from some countries to open an account with them. However, it has many differentiating points compared to other brokers.

It has a social sentiment indicator which mentions traders' sentiment for a particular trading asset. Below is an image portraying the same sentiment indicator.

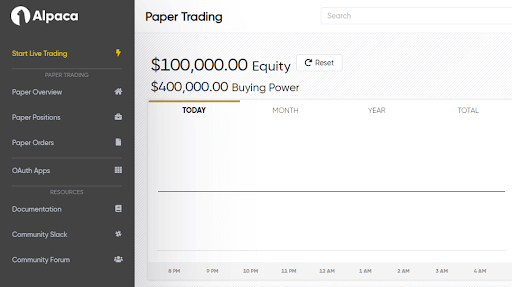

Alpaca

Alpaca is a famous platform for automating your paper trading strategies. It uses IEX Data (IEX is one of the exchanges in US Markets). It uses two APIs for trading, one as your ID and another as a secret key.

Along with its algo paper trading platform, it offers manual trading in partnership with Tradingview.com for a diversified paper trading experience. It supports programming languages like python, C#, Go and Node.

Tradestation

Tradestation is another online broker which provides simulated or paper trading experience to its users. The key differentiator is that it has two market data categories: Real-time data and delayed data.

It charges a minimum fee for real-time data, and for delayed data, the amount is nil. Also, you cannot open a paper trading account until you open a live trading account, which charges USD$500 as an account opening minimum.

Paper trading games

Paper trading games, as the name suggests, are another way to paper trade where brokers provide a simulated game experience platform for making paper trading more exciting and competitive for novice traders.

Listed below are some of the most famous paper trading game platforms and their nuances:

Moneybhai

Moneybhai by moneycontrol.com has a paper trading game platform where they require every participant of the game to follow a set of rules to play the game of paper trading.

They provide every participant with virtual cash of Rs 1 crore, which must be squared off if you are taking intraday positions. To put it in simple words, you need to liquidate your long and short positions if you are trading on an intraday basis. This was one of the rules that a participant needs to follow.

Market Watch

When it comes to paper trading games, Market watch (a Dow Jones & Company subsidiary) is an excellent platform to begin competitive paper trading. The idea is quite simple, and you need to create a game or participate in an already-created game.

We have tried to demonstrate how to create a game in the below images:

Pros of paper trading

Now, we will find out the pros of paper trading. These are-

No real money means no stress of losing money

Paper trading does not involve real money, so you can't lose money with bad decisions or poor timing. Also, paper trading lets you observe all of the wrong decisions in your analytical process so you can create a successful trading strategy.

Trading in the live market usually leads to emotions such as stress, fear, etc. Not practising the trading activity with paper trading can keep the traders from effective risk management, which one comes to know from trial and error in paper trading.

Trader gains practice

With paper trading, a trader gets to experience the live trading process but in a virtual environment. This experience ranges from pre-market preparation to final profit or loss taking. As the paper trader accesses the broker's simulator, they learn how to use real money software in a relaxed environment. Since the wrong keystroke won't trigger a financial disaster in paper trading, the trader learns the proper decision-making for live trading.

Confidence

A series of complex decisions that get rewarded with hypothetical profits goes a long way in building the confidence of a new trader. When real money is at stake, a trader knows what to do most of the time because of the confidence gained from paper trading.

Statistics

Paper trading for several weeks to a month builds valuable statistics about the new strategy and market approach. The results are likely to be discouraging, forcing the next step in the new trader's educational process, requiring additional paper trading and data sets.

Cons of paper trading

Now let's outline the limitations of paper trading and how it can hurt the new trader's performance if key lessons aren't learned.

Market correlation

Paper trading fails to address the broad market's impact on individual securities. Most equities move with major indices during periods of high correlation, which is common when the Volatility Index (VIX) rises. While results may look great or terrible on paper, broader conditions may have created the results rather than the virtues or pitfalls of the individual position.

Slippage and commissions

Traders who trade in the live market deal with hidden costs from slippage and commissions. This is exacerbated by wide spreads that are poorly captured in most paper trading techniques. For example, in the case of the momentum stock, you think you're buying on paper at $50.00 may cost you $50.50 or more in the real world.

Emotional reality

Paper trading doesn't address or evoke real-world emotions from actual profits or losses. In the real world, many traders cut profits short and let losses run because they lack market discipline. Those self-destructive calculations don't come into play when dealing with hypothetical numbers.

Conclusion

In this blog, we discussed most of the concepts relating to paper trading, such as the meaning, importance, skills, and how to practically perform paper trading.

Paper trading is the most useful for amateurs who have no practical idea about the market microstructure and what conclusions each trading decision leads to.

While paper trading is a blessing for the ones who step into the world of stock market trading, there are a few limitations, which, if taken care of with risk management practices, can be avoided.

If you wish to learn more about trading, you must explore our Learning Track on Algorithmic Trading for Beginners. This learning track even consists of different courses for gaining essential skills required for different Quant trading desk roles.

Moreover, with these courses, you can learn the fundamentals of stock markets and how to retrieve financial market data. You can also create and backtest trading strategies such as day trading, event-driven strategy, SARIMA, ARCH, GARCH, volatility and statistical arbitrage trading strategies after learning from these courses.

Our course on Automated Trading with IBridgePy using Interactive Brokers Platform is the course offered by Interactive Brokers. This course can help you take your first step to automate and execute trading strategies in Python.

This useful course covers all essential steps from fetching data to sending orders using a free demo account on the Interactive Brokers trading platform.

Now, you can begin your automated trading practice with paper trading after learning from the informative content in the abovementioned courses.

Happy trading!

Note: The original post has been revamped on 28th February 2023 for accuracy, and recentness.

Disclaimer: All data and information provided in this article are for informational purposes only. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.