By Chainika Thakar & Sushant Ratnaparkhi

To gain an insight into algorithmic trading as a retail trader, this comprehensive guide is sure to serve your purpose well. You will be able to find basic concepts as well as advanced concepts with regard to algorithmic trading.

Moving forward, this article covers:

- What is Algorithmic Trading?

- Why should Retail Traders do Algorithmic Trading?

- How can Retail Traders start Algorithmic Trading?

- Regulations for Retail Algorithmic Trading

- Requirements for setting up a Retail Algorithmic Trading Desk

- Brokers for Retail Algorithmic Trading

- Courses to learn Retail Algorithmic Trading

What is Algorithmic Trading?

In simple words, algorithmic trading implies using a defined set of instructions in the form of algorithms to generate trading signals and placing orders.

Each algorithm can be assumed to have access to real-time and historical prices of instruments that can be bought and sold after performing computations based on the prices. The algorithm may even split the order into small pieces and execute them at different times to get the best possible prices.

According to Economic Times, reports suggest global algorithmic trading market size is expected to grow from $11.1 billion in 2019 to $18.8 billion by 2024, expanding at a compound annual growth rate (CAGR) of 11.1 per cent.

It is also mentioned that algorithmic trading has ushered in a new era for markets, whose benefits are yet to be fully realised. Adapting to this new means of trading can ensure better results. Algo trading is now a 'prerequisite' for surviving in tomorrow's financial markets because the future of trading is in automation.

Algorithmic trading offers several advantages over manual trading. Fast trade execution, accuracy, the ability to discard ‘emotions’ while trading and 100% compliance with the decided algorithmic trading strategy are some of the advantages.

So, should retail traders get into Algorithmic Trading?

Absolutely! Let us find out what is the scenario like for retail traders when it comes to algorithmic trading.

Why should Retail Traders do Algorithmic Trading?

Retail traders are the ones which had remained deprived of algorithmic trading for a long time. But, now, retail traders are showing interest in algorithmic trading since companies or brokers like TD Ameritrade are supporting retail algo traders.

The most important thing is that the retail traders must understand that for getting into the algo trading world, they need to have a sound knowledge of investment and algorithmic trading.

Although, not participating in algorithmic trading may lead to an impact on the retail traders because, in the market, algorithmic traders may have an upper hand over manual traders.

Algorithmic trading brings several benefits also to retail traders in the financial markets. It is known to:

- Increase the speed of execution

- Discipline your trading decisions

- Increase your market reach

- Help make trading systematic

- Help with eliminating constant market monitoring

- To do real-time quantitative analysis

Increase the speed of execution

The main reason is if you are trading a strategy which is profitable for you, you need to be able to increase the speed of execution for making the profitable trades happen quickly.

In trading, you come out profitable only when your wins compensate for your losses. That too, enough so as to account for your efforts and costs. Algorithmic trading is a way to do the same.

Discipline your trading decisions

Another reason is that traditionally retail traders have been trading on the gut feeling based on the ‘feel’ of the market. There is nothing wrong with that especially if you are a seasoned player with a lot of market insights to be put to use.

However, the gut feeling often turns out to be wrong, mostly when there is greed and fear involved. When the markets are falling many amateur traders sell quickly as they fear a further crash. Algorithmic trading follows pre-decided entry-exit rules which prevent such emotional trading and hence avoidable losses.

Increase your market reach

One of the main reasons why Quantitative trading has been gaining popularity is because it allows traders to build strategies quantitatively. Furthermore, it uses modelling techniques to be able to manage risks.

This further enables them to trade in instruments such as options and derivatives which are otherwise too volatile for retail players.

Help make trading systematic

With the preset conditions like time, price, quantity and some other market conditions being met with algorithmic trading, it is known to make the trading systematic. The systematic trading makes more accurate predictions of stock prices and thus, makes trading more advantageous.

Help with eliminating constant market monitoring

Algorithms can monitor and take decisions and execute trades based on market movements. So, the need to continuously monitor the market manually during trading hours is not required.

To do real-time quantitative analysis

Algorithms can run on past data to help traders in analysing strategy’s performance in terms of profit and loss as well as some popular performance statistics like sharpe ratio, alpha, beta, etc.

The ability to backtest and quantify the strategy's return over risk helps the traders to learn from their own mistakes in a simulated environment before running the strategy in live markets.

Before we move ahead, don't forget to read why you should learn algorithmic trading.

How can Retail Traders start Algorithmic Trading?

For starting algorithmic trading, you must have a detailed know-how of certain things. For that, you must invest your time and efforts in the following:

- Knowledge

- Strategies

- Workflow

Knowledge

Getting the knowledge of anything in this world is a must before you take the first step in that particular domain. Once you know about the essentials of algorithmic trading, you will be able to take the best next steps. To gain the knowledge you need:

- Training, for which you can join an organization as a trainee or an intern so as to get familiarized with the work process and ethics.

- You can opt for online courses. Quantra offers many such courses for all levels (beginner, intermediate and expert).

- Books play an essential role since they can be your best guide for starting with algorithmic trading.

For starting with algorithmic trading, you must have the knowledge of:

- types of trading instruments (stocks, options, currencies etc.),

- types of strategies (Trend Following, Mean Reversal etc.),

- arbitrage opportunities,

- options pricing models, and

- risk management

Strategies

Algorithmic trading strategies are several types of ideas for conducting the most profitable algorithmic trade. The most popular strategies are:

- Market Making Strategies

- Arbitrage Strategies

- Statistical Strategies

- Momentum Strategies

- Sentiment Based Trading Strategies

- Machine Learning Trading Strategies

Workflow

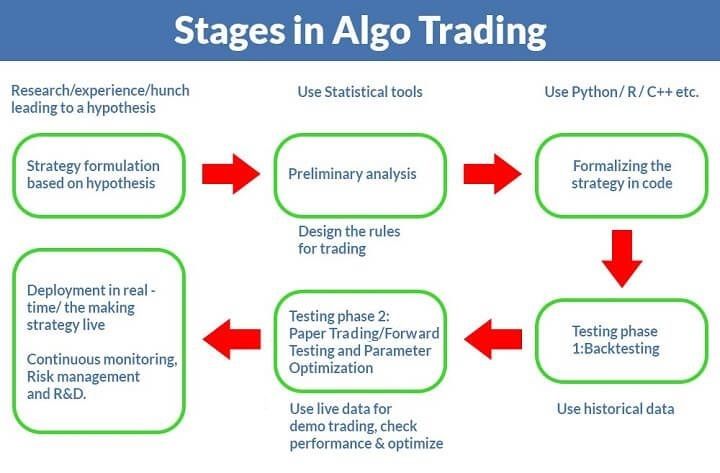

This image shows the stages or the workflow of algorithmic trading. The broker you will be associated with can guide you with these steps. Every broker differs with regard to the steps, and thus, you may find a slight difference but the goal is the same.

Suggested reads:

- Making A Career In Algorithmic Trading

- 5 Things to Know Before Starting Algorithmic Trading

- Learn algorithmic trading

Regulations for Retail Algorithmic Trading

From the exchange point of view if the broker offers its clients an algorithm creating API for automating the trades then it is known as algorithmic trading. These algorithms require approval and are generally managed by the broker who is offering them.

Algorithmic Trading regulations in India

Recently, many brokers in India or third parties offer an API. This API interacts with the web-based broker trading platform such as TWS for Interactive brokers and Kite for Zerodha. These web platforms are exchange approved and have all risk rules in place for internet-based trading.

According to Economic Times on November 29, 2017, Sebi was among the first regulators to issue a discussion paper proposing strengthening of rules on algo trading in August 2016. It produced a set of seven proposals aimed at creating a level playing field between institutional investors and retail investors.

But it did not finalise the regulations due to lack of clarity on the impact of such rules on the market. Moreover, the regulation side is pacing up fast and in India, the regulators are creating a framework for setting the guidelines according to Finapolis.

Algorithmic Trading regulations in the USA

According to mondaq, in 2016, the SEC approved a rule proposed by the Financial Industry Regulatory Authority, Inc. (FINRA) that requires algorithmic trading developers to register as securities traders.

In 2016, the Commodity Futures Trading Commission (CFTC) proposed a supplement to Regulation AT, which would have required, among other things, that the proprietary source code behind trading algorithms be made available to the CFTC and the Department of Justice (DoJ).

The attention that algorithmic trading has received from various regulatory bodies indicates that new regulations are a real possibility in the near future. It is difficult to predict the exact form that such regulation will take, but examining proposals and regulations adopted in other jurisdictions provides useful insight into what we can expect.

Algorithmic Trading regulations in Europe

In Europe, European Securities and Markets Authority (ESMA) is an independent EU authority that contributes to safeguarding the stability of the European Union’s financial system by enhancing the protection of investors and promoting stable and orderly financial markets.

The steps followed by retail traders for getting regulated are simple. You simply need to:

- Open trading account with a broker

- Register for a developer account (this is optional for some brokers)

- Start using the broker's API to build an automated trading system

You will find these steps to follow once you choose a broker’s API. Once you start using the API of the broker, you will be covered with the regulatory measures the broker comes under.

Let us move forward and find out the things needed to set up the trading desk.

Requirements for setting up a Retail Algorithmic Trading Desk

We will cover the “requirements” part with some pointers that will help you understand the things which are quite essential when it comes to trading algorithmic trading. Without these skills and facilities, your algorithmic trading endeavour may remain incomplete.

We will discuss the parameters both in points and then in detail to help you also with the resources to cover each of the following essentials.

This list of requirements for starting retail algorithmic trading goes like this:

- Trading strategy for retail algorithmic trading

- Risk management for retail algorithmic trading

- Programming skills for retail algorithmic trading (Optional)

- Trading software for retail algorithmic trading (Optional)

- Data for retail algorithmic trading

- Capital requirement for retail algorithmic trading

Now, let’s consider each of these parameters in detail.

Trading Strategy for retail algorithmic trading

This is the most important part of algorithmic trading. Make sure your strategy has the following essentials in place:

- Clearly defined rules for trade entry, exit, stop loss and take profit

- Portfolio management which implies strategy that decides which assets to trade

- Risk management is the most important aspect of the strategy since someone great once said ‘There are two ways to make money, one Don’t lose it & two Don’t lose it ’.

- Provision to tackle unexpected events - there will be times when your algorithm just won’t know what to make of the market conditions, such times are rare but they can wipe out your entire portfolio, so make sure you know how to factor this into your algorithms.

Apart from this standard checklist, there are many minor things that you’ll need to make sure in order to become a successful top algorithmic trader. Some of these things are related to programming, exchanges, timings and so on. You won’t notice them until you actually start trading.

The easiest and fastest way to climb this steep ladder of learning is to sign up for online courses.

Programming Skills for retail algorithmic trading (Optional)

You don’t have to be an expert programmer to code your algorithmic trading strategy, however, basic understanding and prior exposure is a must. There are many languages that you can use for coding your trading strategy.

R & Python are most popular among algo traders because of their vast libraries and support offered by various trading software. Although, the brokers you approach may have such features to provide ease with regard to trading as they may not need you to program or code much.

Many have overcome the fear of programming and are quite successful in the domain today.

Trading Software for retail algorithmic trading (Optional)

For good algorithmic trading, there needs to be trading software but it is not mandatory since your broker may provide you with one.

As a retail trader, you can purchase ready-made trading software in case you want to use one for some tasks such as backtesting before executing a trading strategy.

Following are the trading software available which you can choose from:

Features offered by these platforms include real-time scanning, the number of technical indicators, expert advisors, backtesting, company fundamentals, news services, placing trades automatically, forecasting, level 2 data etc.

Importantly, a trader should choose a platform based on his/her trading style, features, and pricing.

Risk Management for retail algorithmic trading

When it comes to algorithmic trading, the number of risks just explodes since there are so many things involved. Here are some of the risks as per their category:

- Access

- Consistency

- Quality

- Algorithm

- Technology

- Scalability

You must ensure that all these risks are actively managed by the broker you choose. Now, I won’t go into details of each as we’ve already covered these risks and ways to mitigate them in detail here.

Data for retail algorithmic trading

You will be requiring historical data for testing your strategy. You can get historical data for almost all trading assets on either google or yahoo finance for free.

Please note that this data is available on larger time scales (day, month, year etc.). While this is fine for low-frequency trading strategies.

But for HFT or high frequency trading strategies, you will require data for smaller time scales (microsecond, millisecond etc.), such data can be fetched from sites like Global data feeds, Thomas Reuters. However, this data is premium, so you’ll have to pay for it depending on the source of historical data.

Second, live data for live trading, you can get it from the exchange directly or from a broker. For HFT algo trading, getting the tick data from the exchange and as early as possible is recommended, and for low-frequency trading, you should be fine with the data provided by the broker with an average delay of about a second.

Capital requirement for retail algorithmic trading

You will require capital for setting up the trading desk as a retailer. Certain things like computer hardware, trading software, data collection from websites etc. are bound to total into your expenses.

Going forward, let us find out the vast world of brokers available for algorithmic trading.

Brokers for Retail Algorithmic Trading

While selecting an algorithmic trading broker, you can consider that broker which is amongst the most reliable ones. We have a list for you in the same context.

First, we have covered brokers for algorithmic trading in India, then we also have provided you with the list of brokers from USA, UK, EU, Singapore and Canada for retail algorithmic trading.

Algorithmic Trading Brokers in India

Algorithmic Trading Brokers in the USA

Algorithmic Trading Brokers in the UK

Algorithmic Trading Brokers in the EU

Algorithmic Trading Brokers in Canada

Hope the list above helps you find the best algorithmic trading broker for you to start algorithmic trading.

Moving forward, let us discuss the quantitative trading courses that will help you with gaining knowledge with regard to the same for successful trading.

Courses to Learn Algorithmic Trading

It’s true, that it takes a lot of work before you start your own algo trading desk, but it’s worth doing it solely because of the advantages and the peace of mind during execution.

This algo trading course is a comprehensive certification programme that is taught by the leading industry experts in online class-room format along with dedicated support manager for faster query resolution.

On the other hand, online self-paced and interactive courses by Quantra provide training on each aspect of algorithmic trading.

For learning how to automate and execute your trades using Interactive Brokers platform, you can go to Ibridgepy course. Also, you can learn about algorithmic trading strategies in the course Algorithmic Trading for everyone.

Conclusion

This article covered the important aspects of retail algorithmic trading and discussed the what, why and how of algorithmic trading. If you want to build a skill with algorithmic trading, a thorough knowledge in the domain is a must.

If you are looking to pursue and venture into algorithmic trading then our comprehensive algo trading course, EPAT, taught by industry experts, trading practitioners and stalwarts like Dr. Ernest Chan, Dr. Euan Sinclair to name a few - is just the thing for you. Enroll now!

Update: We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. In case you are looking for an alternative source for market data, you can use Quandl for the same.

Disclaimer: All data and information provided in this article are for informational purposes only. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.