By Chainika Thakar and Viraj Bhagat

Candlestick patterns play a key role in quantitative trading strategies owing to the simple pattern formation and ease of reading the same. Whether you're a seasoned trader seeking to refine your strategies or a novice taking the first steps into the dynamic world of quantitative trading, the insights gained from understanding candlestick patterns are invaluable.

For using candlestick patterns, you only need to have a basic understanding of how the candlesticks are formed. Also having some idea about the various ways in which these candlesticks can be interpreted would be useful.

However, if you are new to candlesticks trading, this blog will help you gain a complete understanding of candlesticks. Let us begin with the basics as this blog covers:

- What are candlesticks?

- History of candlesticks

- Anatomy of candlesticks

- Qualities of Japanese candlesticks

- Candlestick charts vs normal price charts

- What are candlestick patterns?

- Categories of candlestick patterns

- Representation of Candlesticks

- Types of candlestick patterns

- Candlestick pattern vs Chart pattern

- How to read candlestick patterns?

- Interpreting the candlestick patterns

- How to detect the candlestick patterns in actual charts?

- Benefits of reading candlestick patterns for trading

- Drawbacks of reading candlestick patterns for trading

- Candlestick pattern FAQs

Automated trading using candlestick patterns

Real trading on platform

What are candlesticks?

Candlesticks are used in quantitative trading for representing the Open, High, Low, and Close price movements of the tradable instrument (security, derivative, currency etc.). Candlesticks resemble the shape of a real life candlestick and hence, the name.

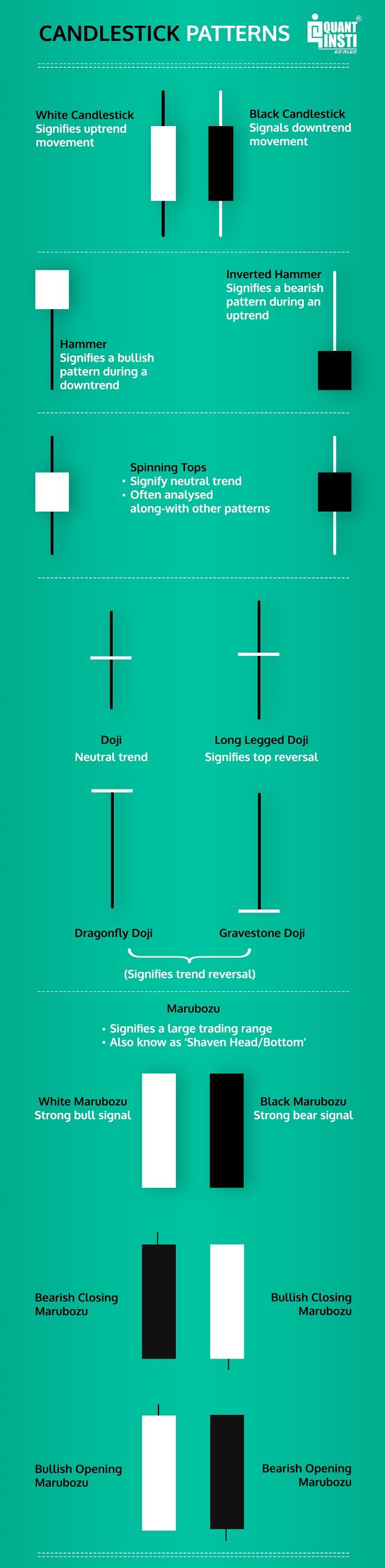

The candlesticks are distinguished by the following colours:

- White Candlesticks or Green Candlesticks: Indicate an uptrend

- Black Candlesticks or Red Candlesticks: Indicate a downtrend

Candlesticks have various sizes, shapes and even colours. The reason for this is that the candlesticks are based on prices. Since the prices keep varying, the size and shape of the candlesticks also vary due to the nature of their anatomy. And that makes them different.

These various shapes and sizes are indicative of market psychology but, at times, can be highly effective in helping you predict the future market direction.

History of candlesticks

Candlesticks were developed in the 17th century in Japan. This is the reason why they are also known as Japanese candlesticks.

After their invention, locals in Japan began using candlesticks while trading rice. This idea was gradually adopted by various people and across countries and kept evolving for the better. The evolution of the same led to what the candlesticks are at present.

Japanese Candlesticks are thought to have been introduced to the West in the book, ‘Japanese Candlestick Charting Techniques by Steve Nison. The West developed the bar point and figure analysis almost 100 years later.

In ancient Japan, the principles were applicable to Rice and today they are applicable to stocks.

Munehisa Homma, a renowned rice merchant from the Japanese town of Sakata, traded in the Dojima market in the 1700s. Further study of candlesticks mentions ‘Sakata’s Methods’ or ‘Sakata’s Rules’, that are based on the name of this particular market.

Homma is said to have developed candlestick charts during his lifetime by studying years of historical data and comparing them with weather conditions. This study also helped him understand the role of emotions on the value and pricing behind the trade of rice.

Anatomy of candlesticks

The anatomy of the Candlesticks has stayed almost similar throughout the ages to give us the current shape and meaning. It consists of 4 distinct values namely:

- The opening price,

- Closing price,

- The highest prices for a given interval, and

- The lowest prices for a given interval.

It’s like a combination of a line chart and a bar chart, where each bar represents all four important pieces of information for an interval.

Candlestick Patterns in Real Trading using Python

Body

The hollow or the filled portion of the candlestick is called as the body of the candlestick.

- Long Body - Indicates heavy trading in one direction and strong buying or selling pressure

- Small Body - Indicates lighter trading or little buying or selling activity

Shadow

The long thin lines above and below the body is called the shadow of the candlestick.

- Upper Shadow - High is marked by the topmost part of the upper shadow

- Lower Shadow - Low is marked by the bottom part of the lower shadow

Vertical line

Candlesticks show and define the price movements as open, close, high and low over a vertical line. It consists of the following:

- Upper tip - High

- Lower tip - Low

- Candle body - The range between Open and Close

- Top End

- Bottom End

And occasionally, you may also observe:

- Upper shadow

- Lower shadow

Further, the body is represented by a Hollow Body Candlestick or a Filled Body Candlestick.

Hollow Body Candlestick

- When the stock closes at a price higher than the opening price

- The body is white

- The bottom of the body depicts the open price

- The top of the body shows the closing value of the stock

Filled Body Candlestick

- When the stock closes at a price lower than the opening price

- The body is black

- The bottom of the body depicts the closing price

- The top of the body shows the opening value of the stock

Qualities of Japanese candlesticks

The qualities of Japanese candlesticks can be listed as follows:

- They are dense

- They are packed with information

- They indicate market psychology and the emotions of buyers and sellers

- They represent trading patterns over a short period of time

- Sometimes, few days or few sessions are required

- They can be used in the technical analysis of currency price patterns and equities

- They can be used for any Forex time frame

What are candlestick patterns?

Candlesticks are the graphical representations of price movements which are commonly formed by the open, high, low, and close prices of a financial instrument. These candlesticks are used to identify the trading patterns which help the technical analysts take the trading positions.

Also, sometimes you will find similar-looking candlesticks or a group of the same appearing frequently which can give you a particular pattern for that very time period.

Automated trading using candlestick patterns

Real trading on platform

Categories of candlestick patterns

Trade analysts use candlestick patterns to recognize market turning points and they are utilised to reduce one’s exposure to market risks. Also, candlestick patterns can be based on two candlesticks and at times even a series of multiple candlesticks can be used.

- Candlestick patterns are divided into the number of Candlesticks: One, Two, Three and more.

- Candlestick patterns are categorised into two broad categories, namely Bullish and Bearish.

Bearish candle

When the body is filled, black or red, it means that the close is lower than the open and is known as the bearish candle.

It implies that the bearish price movements led to the prices going down and hence, the closing price turned out to be lower than the opening price.

Different types of bearish candles

Bullish candle

If the body is empty, is white or green then it means that the close was higher than the open making it a bullish candle.

It implies that the bullish price movements led to the prices going up and hence, the closing price turned out to be higher than the opening price.

Different types of bullish candles

This body depicts the price range between the open and close of the day’s trading.

Difference between Bullish candles and Bearish candles

| Sr. No. | Bullish Candles | Bearish Candles |

| 1 | Most Bullish | Most Bearish |

| 2 | Second-most Bullish | Second-most Bearish |

| 3 | Moderate Bullish | Moderate Bearish |

| 4 | Neutral Bullish | Neutral Bearish |

| 5 | Least Bullish | Least Bearish |

Representation of Candlesticks

The thin vertical lines above and below the body are called the wicks or shadows which represent the high and low prices of the trading session.

The representation of the candlesticks is as follows:

- Strength is represented by a bullish or green candle

- Weakness is represented by a bearish or red candle

- Buying usually is followed by a green candle

- Selling is followed by a red candle

- You must look for a prior trend. If you are looking at a bullish reversal pattern, then the prior trend should be bearish.

- If you are looking for a bearish reversal pattern then the prior trend should be bullish

Types of candlestick patterns

With the variety of candlesticks that are prevalent in the market, it is only with practice that you may gain complete knowledge of each of them.

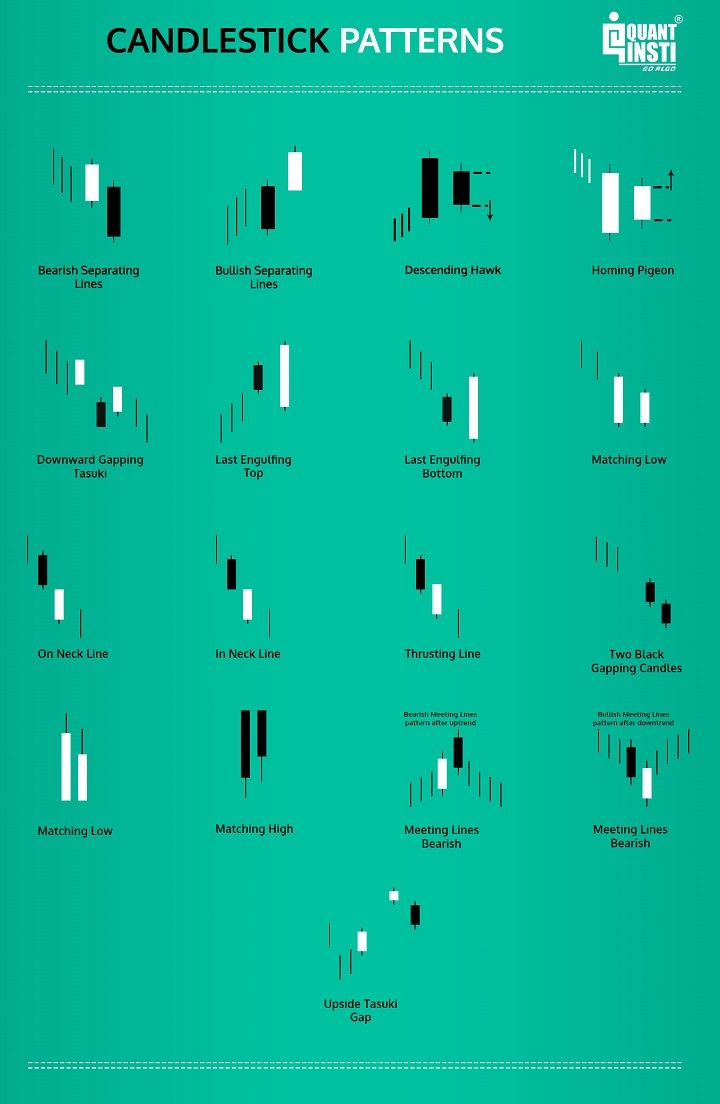

We have compiled all the types of candlestick patterns in one infographic. This infographic will be very useful for those who are using candlestick techniques to monitor market movement and also for those who are learning about them.

Candlestick Patterns in Real Trading using Python

List of candlestick patterns

These are the candlestick patterns represented below:

- Long bullish day

- Long bearish day

- Short day

- Bullish abandoned baby

- Bearish abandoned baby

- Bearish engulfing pattern

- Bullish engulfing pattern

- Bullish harami cross

- Bearish harami cross

- Piercing pattern

- Bullish harami

- Bearish harami

- Bullish kicker

- Bearish kicker

- Dark cloud cover

- Upper window

- Lower window

- Bullish tri star

- Bearish tri star

- Morning doji star

- Evening doji star

- Morning star

- Evening star

- Bullish doji star

- Bearish doji star

- Shooting star

- Bullish spinning top

- Bearish spinning top

- Tweezers top

- Tweezers bottom

- Three inside up

- Three outside up

- Bullish three line strike

- Bearish three line strike

- Hanging man

- Three white soldiers

- Three black crows

- Three inside down

- Three outside down

- Bearish separating lines

- Bullish separating lines

- Descending hawk

- Horning pigeon

- Downward gapping tasuki

- Last engulfing top

- Last engulfing bottom

- Matching low

- In neck line

- On neck line

- Thrusting line

- Two black gapping candles

- Matching low

- Matching high

- Meeting lines bearish

- Meeting lines bullish

- Upside tasuki gap

Candlestick Patterns in Real Trading using Python

Candlestick pattern vs Chart pattern

Just to give you an idea of how it would look, we will use a sample of State Bank of India to show its Candlestick Patterns during a single Day.

Whereas, a chart pattern looks like this:

| Candlestick pattern | Chart pattern |

| An accumulation of one or more candlestick forms a candlestick pattern. |

A price change of the financial instrument (stock, derivative etc.) due to aspects such as psychological and fundamental over a period of time leads to a chart pattern.

|

| A candlestick pattern gets formed over a short time span. |

The chart trend direction appears over a long time span.

|

| Entry and exit points are also short-term. |

The pattern shows long term buying and selling signals.

|

How to read candlestick patterns?

Reading candlestick patterns is quite easy once you know how to do the same. Let us find out the interpretation of candlestick patterns as well as the detection of a candlestick pattern in the chart.

Automated trading using candlestick patterns

Real trading on platform

Interpreting candlestick patterns

You may have come across a lot of candlestick patterns, but do you know the interpretation of some commonly observed patterns?

Following are some candlesticks and their interpretation that will be helpful for trading:

How to detect the candlestick patterns in actual charts?

A daily candlestick chart shows the security’s open, high, low, and close price for the day. The candlestick’s body (which we discussed above) shows the link between opening and closing prices.

Automated trading using candlestick patterns

Real trading on platform

You can detect these simple candlestick patterns which are:

- Bullish swing

- Bearish swing

- Bullish pin bar

- Bearish pin bar

- Inside bar

- Outside bar

Bullish swing

Bullish swing is a simple one which is a 3-candle pattern. The second candle has the lowest low among the three. It signals a possible bullish movement in the prices.

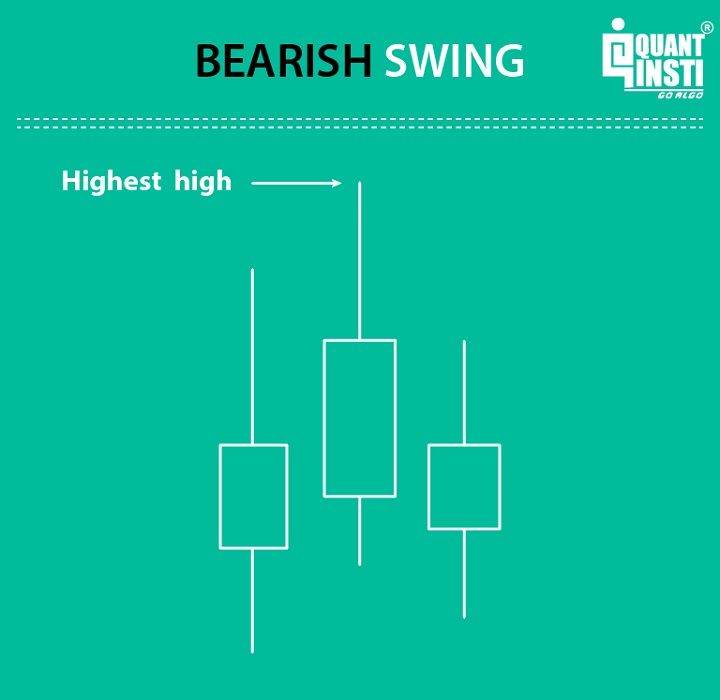

Bearish swing

A bearish swing is the opposite of a bullish swing. It is also a 3-candle pattern and the second candle here, has the highest high.

Bullish pin bar

Pin bars are quite frequent and are the most powerful patterns. It is commonly known that a pin bar has a very long shadow and a small body.

Also, a pin bar is not only such a candle, but it must come from the surrounding price action. Hence, a bullish pin bar must have a lower low with respect to the previous candle.

A “small” body can be defined as a body whose width is less than the candle range divided by 3. A bullish pin bar will then have the body located in the upper half of the candle.

Bearish pin bar

The bearish pin bar is similar to the bullish pin bar, but the body is now located in the lower half of the candle and it has a higher high than the previous candle.

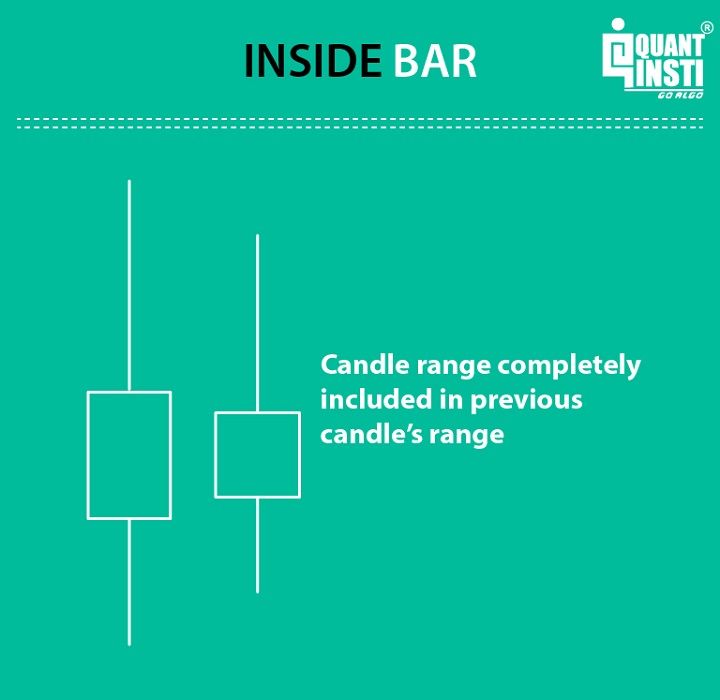

Inside bar

Inside bar is a pattern that is made of two candles. The second entire candle is included in the range of the first candle.

The inside bar pattern shows a contraction in volatility that may be a prelude to a strong directional explosion.

Candlestick Patterns in Real Trading using Python

Outside bar

The outside bar is the opposite of the inside bar. The candle range includes the entire previous candle.

Benefits of reading candlestick patterns for trading

The benefits of reading candlestick patterns for trading can be listed as follows:

Candlestick charts portray the market in detail

Candlestick charts show us the price action that took place in the assets in detail. After a small amount of timely usage, candlestick chart pattern analysis can play an integral role in the day-to-day life of a trader. Learn Price Action Trading Strategies in detail in the Quantra course.

Sentiment analysis is easier with candlestick charts

Price movements of financial instruments in the markets are usually followed by a decision taken under the influence of emotions such as greed, fear, and hope.

With a candlesticks pattern, you can successfully read the changes in the market without letting emotions come in the way. This is also known as investor sentiment. Candlestick charts do this by displaying the interaction between buyers and sellers, which is often reflected in price movement.

Easier to interpret

Candlesticks patterns visually provide a clear and easy set of patterns that are highly accurate. By using candlesticks charts, mixing with some basic technical analysis, you can easily spot to see patterns that emerge in the market. Also, you can start taking profits from these patterns when you trade.

Why candlesticks are used in Trading

In addition to these, these are also the reasons why candlesticks are used in trading:

- They are easy to comprehend

- Patterns are easy to identify

- They can be used in conjunction with other Indicators

- Provide a much more detailed description of the occurrences and happenings in the market, and interactions between buyers and sellers as compared to traditional charts which provide minimal information

- They allow us to understand the sentiment of Investors and the values being determined by the market

- The colour and length of candles help determine if the market is Bearish (weakening) or Bullish (growing) at a glance

- They indicate market turning points early and estimate the direction of the market

- Overall, Candlesticks provide unique insights

- They display reversal patterns which cannot be seen in other types of charts

- They can be used in all kinds of markets

- Candlestick Patterns are highly accurate in predicting market trends

Candlestick Patterns in Real Trading using Python

Drawbacks of reading candlestick patterns for trading

The drawbacks of reading candlestick patterns for trading can be listed as follows:

A candlestick can look different in every time-frame

A candlestick pattern might seem perfectly formed in one timeframe but it can also appear completely opposite in another. This makes it difficult to trust the message of a candlestick pattern 100 percent. Therefore it can cause doubt for traders to decide and execute their trades. If the candlestick is of sufficient size, it might appear on multiple timeframes, but this is an uncommon occurrence.

Unreliability of candlestick patterns over the higher frequencies

During the high frequencies such as a minute data will have a lot of candlestick patterns but a lot of price fluctuations will make it highly difficult to trade. This can lead to an impact on your risk management practice while trading. This course on candlestick patterns course by Quantra is just what you need to get the best out of your trading.

Lagging indicator

In technical analysis, candlestick patterns are often considered a lagging indicator because you need to wait until the close of a candle before entering a trade. This has many drawbacks, with the most important being that lagging indicators only record the results, so it leaves room for the trader to decide or speculate on the next price movements.

Candlestick pattern FAQs

Q: Why do Candlesticks have different shapes and sizes?

A: Candlesticks are based on prices. Since the prices keep varying, the size and shape of the candlesticks also vary due to their anatomy and that makes them different. These various shapes and sizes are indicative of market psychology but are highly effective in helping one predict the future market direction.

Q: What is Marubozu?

A: Marubozu means "shaven". They are the Candlesticks without any shadow.

Q: What is Doji?

A: Doji means "unskillfully formed". They are the Candlesticks without a body.

Q: What is Harami?

A: Harami means "pregnant". Harami is a Candlestick pattern formed by 2 Candlesticks namely one big (mother) and one small (baby), thus the name.

Q: Can one rely on candlestick patterns?

A: Whether one can rely on the candlestick patterns or not is an individual choice of the trader. Candlestick patterns are more convenient for some traders who follow the market in short intervals. For instance, most of the day traders find it convenient to rely on the candlestick patterns.

Conclusion

Remember, each pattern tells a story, reflecting the emotions of market participants and providing a glimpse into potential future price movements. As you embark on your journey to decipher these patterns, consider the benefits and drawbacks, acknowledge their reliability over different timeframes, and recognize the nuanced language they speak.

Candlestick patterns are the most interesting and simple way of predicting the prices for creating your unique trading strategies. Although there are a lot of candlestick patterns that you can look at, a subtle practice of reading and interpreting candlestick patterns can help you predict and design strategies more effectively.

Candlestick patterns are one of the predictive techniques used by traders all over the world. The candlestick charts are used in stock markets and forex markets among others.

Knowledge of Candlesticks proves to be invaluable. One can learn about Candlesticks and with some effort, one can memorise Candlestick Patterns quickly and apply this knowledge in a short time.

Explore our course on Python for trading in order to utilise Python coding for making your candlestick pattern reading convenient. The computer language can help you code in order to run a backtest on your candlestick patterns, for data analysis and for generating trading signals.

Note: The original post has been revamped on 22nd August 2022 for accuracy, and recentness.

Disclaimer: All investments and trading in the stock market involve risk. Any decision to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. The trading strategies or related information mentioned in this article is for informational purposes only.